Legendary investors such as Leon Cooperman and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those successful funds in these small-cap stocks. In the following paragraphs, we analyze Simpson Manufacturing Co, Inc. (NYSE:SSD) from the perspective of those successful funds.

Simpson Manufacturing Co, Inc. (NYSE:SSD) investors should be aware of a decrease in support from the world’s most successful money managers last quarter. There were 13 funds in our database with SSD positions at the end of the previous quarter. At the end of this article we will also compare SSD to other stocks including Big Lots, Inc. (NYSE:BIG), AdvancePierre Foods Holdings Inc (NYSE:APFH), and Tri Pointe Homes Inc (NYSE:TPH) to get a better sense of its popularity.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

dcwcreations/Shutterstock.com

Now, let’s take a glance at the recent action surrounding Simpson Manufacturing Co, Inc. (NYSE:SSD).

What have hedge funds been doing with Simpson Manufacturing Co, Inc. (NYSE:SSD)?

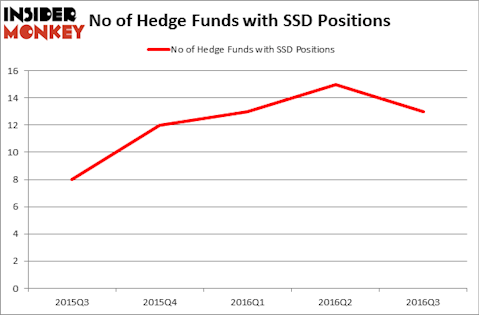

At Q3’s end, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, compared to 15 funds at the end of June. The graph below displays the number of hedge funds with bullish position in SSD over the last 5 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, John W. Rogers’ Ariel Investments holds the most valuable position in Simpson Manufacturing Co, Inc. (NYSE:SSD). Ariel Investments has a $108.2 million position in the stock, comprising 1.3% of its 13F portfolio. The second largest stake is held by Chuck Royce’s Royce & Associates, with a $52.4 million position. Remaining hedge funds and institutional investors with similar optimism encompass Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Ken Griffin’s Citadel Investment Group, and Jim Simons’ Renaissance Technologies, which is one of the largest hedge funds in the world. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

We already know that not all hedge funds are bullish on the stock and some hedge funds actually dumped their positions entirely. Intriguingly, Paul Marshall and Ian Wace’s Marshall Wace LLP dumped the largest stake of all the investors watched by Insider Monkey, valued at an estimated $1 million in stock, and Joel Greenblatt’s Gotham Asset Management was right behind this move, as the fund dumped about $0.5 million worth of shares.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Simpson Manufacturing Co, Inc. (NYSE:SSD) but similarly valued. These stocks are Big Lots, Inc. (NYSE:BIG), AdvancePierre Foods Holdings Inc (NYSE:APFH), Tri Pointe Homes Inc (NYSE:TPH), and Steven Madden, Ltd. (NASDAQ:SHOO). All of these stocks’ market caps are closest to SSD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BIG | 26 | 161909 | 0 |

| APFH | 10 | 1311920 | 10 |

| TPH | 25 | 242290 | 3 |

| SHOO | 4 | 25248 | -7 |

As you can see these stocks had an average of 16 hedge funds with bullish positions and the average amount invested in these stocks was $435 million. That figure was $189 million in SSD’s case. Big Lots, Inc. (NYSE:BIG) is the most popular stock in this table. On the other hand Steven Madden, Ltd. (NASDAQ:SHOO) is the least popular one with only four bullish hedge fund positions. Simpson Manufacturing Co, Inc. (NYSE:SSD) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard BIG might be a better candidate to consider taking a long position in.

Disclosure: None