At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Third Point because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

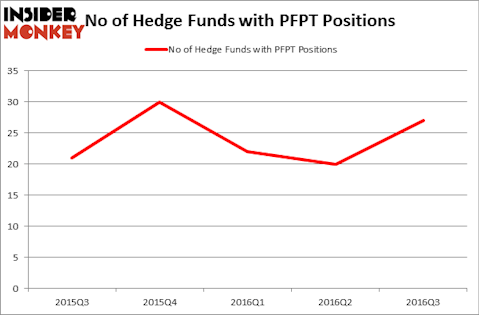

Proofpoint Inc (NASDAQ:PFPT) was in 27 hedge funds’ portfolios at the end of the third quarter of 2016. PFPT has seen an increase in hedge fund interest recently. There were 20 hedge funds in our database with PFPT holdings at the end of the previous quarter. At the end of this article we will also compare PFPT to other stocks including Zebra Technologies Corp. (NASDAQ:ZBRA), Buffalo Wild Wings (NASDAQ:BWLD), and Science Applications International Corp (NYSE:SAIC) to get a better sense of its popularity.

Follow Proofpoint Inc (NASDAQ:PFPT)

Follow Proofpoint Inc (NASDAQ:PFPT)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

bluebay/Shutterstock.com

What have hedge funds been doing with Proofpoint Inc (NASDAQ:PFPT)?

At the end of the third quarter, a total of 27 of the hedge funds tracked by Insider Monkey were bullish on this stock, a gain of 35% from one quarter earlier. With the smart money’s capital changing hands, there exists a few key hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Millennium Management, managed by Israel Englander, holds the number one position in Proofpoint Inc (NASDAQ:PFPT). Millennium Management has a $37.4 million position in the stock. On Millennium Management’s heels is Brian Ashford-Russell and Tim Woolley of Polar Capital, with a $31.2 million position. Other hedge funds and institutional investors that are bullish contain John Overdeck and David Siegel’s Two Sigma Advisors, Glen Kacher’s Light Street Capital and Principal Global Investors’s Columbus Circle Investors.

As industrywide interest jumped, key money managers were breaking ground themselves. York Capital Management, managed by James Dinan, assembled the biggest position in Proofpoint Inc (NASDAQ:PFPT). York Capital Management had $9 million invested in the company at the end of the quarter. Wojciech Uzdelewicz’s Espalier Global Management also initiated a $3.7 million position during the quarter. The other funds with new positions in the stock are Matthew Hulsizer’s PEAK6 Capital Management, George Hall’s Clinton Group, and Frank Slattery’s Symmetry Peak Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Proofpoint Inc (NASDAQ:PFPT) but similarly valued. We will take a look at Zebra Technologies Corp. (NASDAQ:ZBRA), Buffalo Wild Wings (NASDAQ:BWLD), Science Applications International Corp (NYSE:SAIC), and United Bankshares, Inc. (NASDAQ:UBSI). This group of stocks’ market values are similar to PFPT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ZBRA | 17 | 533933 | -2 |

| BWLD | 29 | 369089 | 4 |

| SAIC | 15 | 80466 | -1 |

| UBSI | 8 | 38600 | 2 |

As you can see these stocks had an average of 17 hedge funds with bullish positions and the average amount invested in these stocks was $256 million. That figure was $220 million in PFPT’s case. Buffalo Wild Wings (NASDAQ:BWLD) is the most popular stock in this table. On the other hand United Bankshares, Inc. (NASDAQ:UBSI) is the least popular one with only 8 bullish hedge fund positions. Proofpoint Inc (NASDAQ:PFPT) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard BWLD might be a better candidate to consider a long position.

Disclosure: None