How do you pick the next stock to invest in? One way would be to spend hours of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding Owens Corning (NYSE:OC).

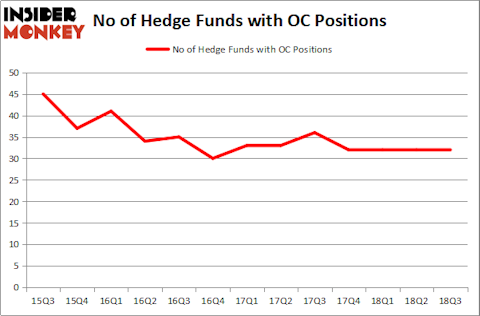

Owens Corning (NYSE:OC) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 32 hedge funds’ portfolios at the end of the third quarter of 2018. At the end of this article we will also compare OC to other stocks including Western Alliance Bancorporation (NYSE:WAL), Teladoc Inc (NYSE:TDOC), and People’s United Financial, Inc. (NASDAQ:PBCT) to get a better sense of its popularity.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s check out the recent hedge fund action regarding Owens Corning (NYSE:OC).

Hedge fund activity in Owens Corning (NYSE:OC)

At the end of the third quarter, a total of 32 of the hedge funds tracked by Insider Monkey were long this stock, no change from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in OC over the last 13 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Iridian Asset Management held the most valuable stake in Owens Corning (NYSE:OC), which was worth $187.3 million at the end of the third quarter. On the second spot was AQR Capital Management which amassed $164.1 million worth of shares. Moreover, Adage Capital Management, PAR Capital Management, and Citadel Investment Group were also bullish on Owens Corning (NYSE:OC), allocating a large percentage of their portfolios to this stock.

Because Owens Corning (NYSE:OC) has faced falling interest from the aggregate hedge fund industry, logic holds that there is a sect of money managers who were dropping their full holdings by the end of the third quarter. It’s worth mentioning that Steve Cohen’s Point72 Asset Management said goodbye to the biggest stake of the “upper crust” of funds watched by Insider Monkey, worth close to $44 million in stock. David Costen Haley’s fund, HBK Investments, also dropped its stock, about $6.7 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Owens Corning (NYSE:OC) but similarly valued. These stocks are Western Alliance Bancorporation (NYSE:WAL), Teladoc Health, Inc. (NYSE:TDOC), People’s United Financial, Inc. (NASDAQ:PBCT), and Ternium S.A. (NYSE:TX). This group of stocks’ market values are closest to OC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WAL | 23 | 370751 | 0 |

| TDOC | 19 | 358433 | 0 |

| PBCT | 20 | 121306 | 7 |

| TX | 14 | 128533 | -1 |

| Average | 19 | 244756 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19 hedge funds with bullish positions and the average amount invested in these stocks was $245 million. That figure was $1.04 billion in OC’s case. Western Alliance Bancorporation (NYSE:WAL) is the most popular stock in this table. On the other hand Ternium S.A. (NYSE:TX) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Owens Corning (NYSE:OC) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.