Is J.B. Hunt Transport Services Inc (NASDAQ:JBHT) a good investment right now? We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, expert networks, and get tips from industry insiders. They fail miserably sometimes but historically their consensus stock picks outperformed the market after adjusting for known risk factors.

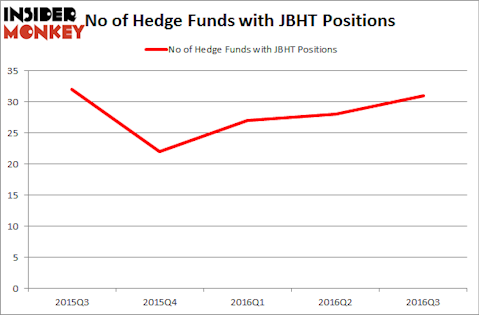

J.B. Hunt Transport Services Inc (NASDAQ:JBHT) investors should be aware of an increase in hedge fund interest recently. At the end of September 31 funds tracked by Insider Monkey held shares of the company, compared to 28 funds a quarter earlier. At the end of this article we will also compare JBHT to other stocks including ResMed Inc. (NYSE:RMD), LG Display Co Ltd. (ADR) (NYSE:LPL), and Garmin Ltd. (NASDAQ:GRMN) to get a better sense of its popularity.

Follow Hunt J B Transport Services Inc (NASDAQ:JBHT)

Follow Hunt J B Transport Services Inc (NASDAQ:JBHT)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

IM_photo/Shutterstock.com

With all of this in mind, let’s view the latest action encompassing J.B. Hunt Transport Services Inc (NASDAQ:JBHT).

How have hedgies been trading J.B. Hunt Transport Services Inc (NASDAQ:JBHT)?

Heading into the fourth quarter of 2016, a total of 31 of the hedge funds followed by Insider Monkey held long positions in .B. Hunt Transport Services, which represents a change of 11% from the second quarter of 2016. The graph below displays the number of hedge funds with bullish position in JBHT over the last five quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Hitchwood Capital Management, led by James Crichton, holds the most valuable position in J.B. Hunt Transport Services Inc (NASDAQ:JBHT). Hitchwood Capital Management has a $73 million position in the stock, comprising 2.2% of its 13F portfolio. The second largest stake is held by Lee Hicks and Jan Koerner’s Park Presidio Capital, with a $44.6 million position; 7% of its 13F portfolio is allocated to the company. Some other hedge funds and institutional investors that hold long positions consist of Jim Simons’ Renaissance Technologies, John Overdeck and David Siegel’s Two Sigma Advisors, and Israel Englander’s Millennium Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.