Hedge funds are not perfect. They have their bad picks just like everyone else. Facebook, a stock hedge funds have loved, lost a third of its value since the end of July. Although hedge funds are not perfect, their consensus picks do deliver solid returns, however. Our data show the top 30 S&P 500 stocks among hedge funds at the end of September 2018 yielded an average return of 6.7% year-to-date, vs. a gain of 2.6% for the S&P 500 Index. Because hedge funds have a lot of resources and their consensus picks do well, we pay attention to what they think. In this article, we analyze what the elite funds think of GNC Holdings Inc (NYSE:GNC).

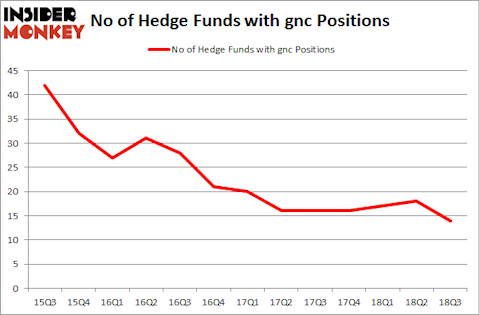

GNC Holdings Inc (NYSE:GNC) has seen a decrease in activity from the world’s largest hedge funds of late. Our calculations also showed that gnc isn’t among the 30 most popular stocks among hedge funds.

At the moment there are numerous signals stock traders put to use to assess stocks. Two of the most useful signals are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the top picks of the elite money managers can beat the broader indices by a very impressive amount (see the details here).

Let’s go over the fresh hedge fund action regarding GNC Holdings Inc (NYSE:GNC).

How have hedgies been trading GNC Holdings Inc (NYSE:GNC)?

At the end of the third quarter, a total of 14 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -22% from the previous quarter. By comparison, 16 hedge funds held shares or bullish call options in GNC heading into this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Pomelo Capital held the most valuable stake in GNC Holdings Inc (NYSE:GNC), which was worth $9.2 million at the end of the third quarter. On the second spot was DC Capital Partners which amassed $6.8 million worth of shares. Moreover, Tenzing Global Investors, Millennium Management, and Tiger Management were also bullish on GNC Holdings Inc (NYSE:GNC), allocating a large percentage of their portfolios to this stock.

Seeing as GNC Holdings Inc (NYSE:GNC) has faced declining sentiment from the smart money, we can see that there were a few hedge funds that elected to cut their full holdings last quarter. Interestingly, Julian Robertson’s Tiger Management said goodbye to the largest investment of all the hedgies monitored by Insider Monkey, valued at an estimated $1 million in stock, and Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital was right behind this move, as the fund sold off about $0.1 million worth. These transactions are intriguing to say the least, as total hedge fund interest dropped by 4 funds last quarter.

Let’s now review hedge fund activity in other stocks similar to GNC Holdings Inc (NYSE:GNC). We will take a look at Landmark Infrastructure Partners LP (NASDAQ:LMRK), Consolidated-Tomoka Land Co. (NYSE:CTO), Source Capital, Inc. (NYSE:SOR), and Corium International Inc (NASDAQ:CORI). This group of stocks’ market caps are closest to GNC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LMRK | 4 | 4476 | 2 |

| CTO | 9 | 137055 | 2 |

| SOR | 1 | 9271 | 0 |

| CORI | 12 | 108748 | 3 |

| Average | 6.5 | 64888 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.5 hedge funds with bullish positions and the average amount invested in these stocks was $65 million. That figure was $29 million in GNC’s case. Corium International Inc (NASDAQ:CORI) is the most popular stock in this table. On the other hand Source Capital, Inc. (NYSE:SOR) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks GNC Holdings Inc (NYSE:GNC) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.