How do we determine whether Fiat Chrysler Automobiles NV (NYSE:FCAU) makes for a good investment at the moment? We analyze the sentiment of a select group of the very best investors in the world, who spend immense amounts of time and resources studying companies. They may not always be right (no one is), but data shows that their consensus long positions have historically outperformed the market when we adjust for known risk factors.

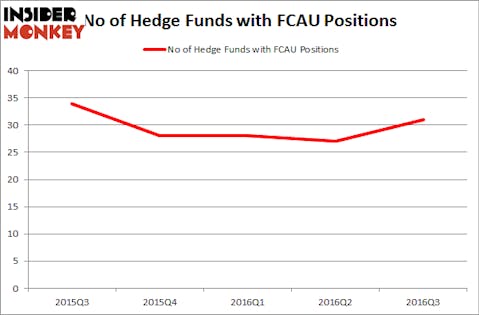

Fiat Chrysler Automobiles NV (NYSE:FCAU) has seen an increase in support from the world’s most successful money managers of late. There were 27 hedge funds in our database with FCAU positions at the end of the previous quarter. At the end of this article we will also compare FCAU to other stocks including SL Green Realty Corp (NYSE:SLG), ONEOK, Inc. (NYSE:OKE), and Vantiv Inc (NYSE:VNTV) to get a better sense of its popularity.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Ollyy/Shutterstock.com

Keeping this in mind, we’re going to review the new action surrounding Fiat Chrysler Automobiles NV (NYSE:FCAU).

What have hedge funds been doing with Fiat Chrysler Automobiles NV (NYSE:FCAU)?

At the end of the third quarter, a total of 31 of the hedge funds tracked by Insider Monkey were bullish on this stock, up 15% from the second quarter of 2016. On the other hand, there were a total of 28 hedge funds with a bullish position in FCAU at the beginning of this year. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, OZ Management, led by Daniel S. Och, holds the largest position in Fiat Chrysler Automobiles NV (NYSE:FCAU). According to regulatory filings, the fund has a $133.2 million position in the stock, comprising 0.8% of its 13F portfolio. The second most bullish fund manager is Cliff Asness of AQR Capital Management, with a $125.1 million position; 0.2% of its 13F portfolio is allocated to the company. Remaining peers with similar optimism include D. E. Shaw’s D E Shaw, Mohnish Pabrai’s Mohnish Pabrai and David Costen Haley’s HBK Investments. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

With a general bullishness amongst the heavyweights, specific money managers were breaking ground themselves. Raging Capital Management, led by William C. Martin, created the biggest call position in Fiat Chrysler Automobiles NV (NYSE:FCAU). According to its latest 13F filing, the fund had $57.6 million invested in the company at the end of the quarter. Noam Gottesman’s GLG Partners also initiated a $3.3 million position during the quarter. The following funds were also among the new FCAU investors: Scott Lawrence Swid’s SLS Management, Bart Baum’s Ionic Capital Management, and Benjamin A. Smith’s Laurion Capital Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Fiat Chrysler Automobiles NV (NYSE:FCAU) but similarly valued. We will take a look at SL Green Realty Corp (NYSE:SLG), ONEOK, Inc. (NYSE:OKE), Vantiv Inc (NYSE:VNTV), and Hologic, Inc. (NASDAQ:HOLX). This group of stocks’ market valuations resemble FCAU’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SLG | 24 | 201026 | 3 |

| OKE | 14 | 73303 | -4 |

| VNTV | 27 | 599646 | -2 |

| HOLX | 33 | 812836 | -2 |

As you can see these stocks had an average of 25 hedge funds with bullish positions and the average amount invested in these stocks was $422 million. That figure was $717 million in FCAU’s case. Hologic, Inc. (NASDAQ:HOLX) is the most popular stock in this table. On the other hand ONEOK, Inc. (NYSE:OKE) is the least popular one with only 14 bullish hedge fund positions. Fiat Chrysler Automobiles NV (NYSE:FCAU) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard HOLX might be a better candidate to consider taking a long position in.

Disclosure: none.