A market correction in the fourth quarter, spurred by a number of global macroeconomic concerns and rising interest rates ended up having a negative impact on the markets and many hedge funds as a result. The stocks of smaller companies were especially hard hit during this time as investors fled to investments seen as being safer. This is evident in the fact that the Russell 2000 ETF underperformed the S&P 500 ETF by 4 percentage points during the first half of the fourth quarter. We also received indications that hedge funds were trimming their positions amid the market volatility and uncertainty, and given their greater inclination towards smaller cap stocks than other investors, it follows that a stronger sell-off occurred in those stocks. Let’s study the hedge fund sentiment to see how those concerns affected their ownership of EnPro Industries, Inc. (NYSE:NPO) during the quarter.

EnPro Industries, Inc. (NYSE:NPO) shareholders have witnessed an increase in activity from the world’s largest hedge funds in recent months. Our calculations also showed that NPO isn’t among the 30 most popular stocks among hedge funds.

According to most market participants, hedge funds are perceived as underperforming, outdated financial vehicles of years past. While there are more than 8,000 funds with their doors open at present, Our researchers hone in on the aristocrats of this group, about 700 funds. These money managers handle most of the hedge fund industry’s total asset base, and by keeping an eye on their top investments, Insider Monkey has come up with numerous investment strategies that have historically surpassed the S&P 500 index. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by 6 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Mario Gabelli of GAMCO Investors

Let’s take a gander at the latest hedge fund action surrounding EnPro Industries, Inc. (NYSE:NPO).

Hedge fund activity in EnPro Industries, Inc. (NYSE:NPO)

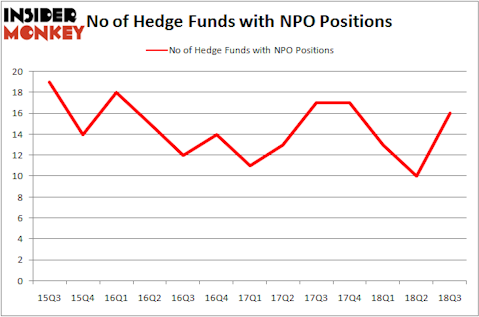

At the end of the third quarter, a total of 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 60% from the previous quarter. The graph below displays the number of hedge funds with bullish position in NPO over the last 13 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

The largest stake in EnPro Industries, Inc. (NYSE:NPO) was held by GAMCO Investors, which reported holding $83 million worth of stock at the end of September. It was followed by Daruma Asset Management with a $29.9 million position. Other investors bullish on the company included Millennium Management, Citadel Investment Group, and GLG Partners.

As one would reasonably expect, specific money managers have jumped into EnPro Industries, Inc. (NYSE:NPO) headfirst. GLG Partners, managed by Noam Gottesman, initiated the largest position in EnPro Industries, Inc. (NYSE:NPO). GLG Partners had $3.1 million invested in the company at the end of the quarter. Ian Cumming and Joseph Steinberg’s Leucadia National also initiated a $1.3 million position during the quarter. The following funds were also among the new NPO investors: Joel Greenblatt’s Gotham Asset Management, Matthew Hulsizer’s PEAK6 Capital Management, and Mike Vranos’s Ellington.

Let’s now review hedge fund activity in other stocks similar to EnPro Industries, Inc. (NYSE:NPO). These stocks are Inovalon Holdings Inc (NASDAQ:INOV), Kratos Defense & Security Solutions, Inc (NASDAQ:KTOS), Oclaro, Inc. (NASDAQ:OCLR), and Oxford Industries, Inc. (NYSE:OXM). This group of stocks’ market values match NPO’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| INOV | 13 | 23987 | 1 |

| KTOS | 13 | 132648 | 1 |

| OCLR | 22 | 137595 | 3 |

| OXM | 13 | 70925 | 0 |

| Average | 15.25 | 91289 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.25 hedge funds with bullish positions and the average amount invested in these stocks was $91 million. That figure was $137 million in NPO’s case. Oclaro, Inc. (NASDAQ:OCLR) is the most popular stock in this table. On the other hand Inovalon Holdings Inc (NASDAQ:INOV) is the least popular one with only 13 bullish hedge fund positions. EnPro Industries, Inc. (NYSE:NPO) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard OCLR might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.