We at Insider Monkey have gone over 742 13F filings that hedge funds and prominent investors are required to file by the government. The 13F filings show the funds’ and investors’ portfolio positions as of September 30. In this article, we look at what those funds think of Energy Transfer Partners LP (NYSE:ETP) based on that data.

Hedge fund interest in Energy Transfer Partners LP (NYSE:ETP) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Ecopetrol S.A. (ADR) (NYSE:EC), Sirius XM Holdings Inc (NASDAQ:SIRI), and The Progressive Corporation (NYSE:PGR) to gather more data points.

Follow Energy Transfer Lp (NYSE:ETP)

Follow Energy Transfer Lp (NYSE:ETP)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Zorandim/Shutterstock.com

Now, we’re going to check out the fresh action regarding Energy Transfer Partners LP (NYSE:ETP).

Hedge fund activity in Energy Transfer Partners LP (NYSE:ETP)

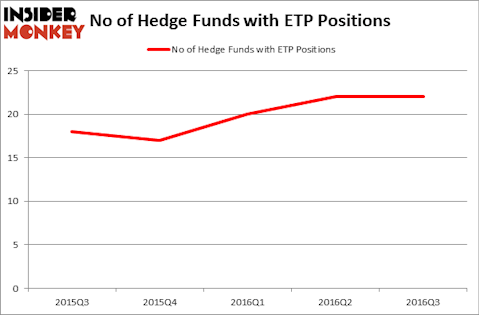

At the end of the third quarter, a total of 22 of the hedge funds tracked by Insider Monkey held long positions in this stock, unchanged from the previous quarter. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, David Tepper’s Appaloosa Management LP has the largest position in Energy Transfer Partners LP (NYSE:ETP), worth close to $429.8 million and corresponding to 9.8% of its total 13F portfolio. The second most bullish fund manager is Soroban Capital Partners, led by Eric W. Mandelblatt, holding a $129.5 million call position; 0.8% of its 13F portfolio is allocated to the stock. Remaining members of the smart money with similar optimism comprise Jim Simons’s Renaissance Technologies, Leon Cooperman’s Omega Advisors and Don Morgan’s Brigade Capital.

Seeing as Energy Transfer Partners LP (NYSE:ETP) has witnessed no changed in sentiment from the smart money, we should take a look at a select few money managers who were dropping their full holdings by the end of the third quarter. At the top of the heap, Christopher A. Winham’s Tide Point Capital said goodbye to the biggest position of the “upper crust” of funds monitored by Insider Monkey, worth about $76.1 million in stock. Marc Lisker, Glenn Fuhrman and John Phelan’s fund, MSDC Management, also dropped its holding, about $12.3 million worth of ETP shares. These bearish behaviors are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks similar to Energy Transfer Partners LP (NYSE:ETP). We will take a look at Ecopetrol S.A. (ADR) (NYSE:EC), Sirius XM Holdings Inc (NASDAQ:SIRI), The Progressive Corporation (NYSE:PGR), and Franklin Resources, Inc. (NYSE:BEN). This group of stocks’ market valuations are similar to ETP’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EC | 8 | 58450 | 0 |

| SIRI | 27 | 894484 | 5 |

| PGR | 29 | 914281 | -1 |

| BEN | 32 | 1957076 | 0 |

As you can see these stocks had an average of 24 hedge funds with bullish positions and the average amount invested in these stocks was $956 million. That figure was $957 million in ETP’s case. Franklin Resources, Inc. (NYSE:BEN) is the most popular stock in this table. On the other hand Ecopetrol S.A. (ADR) (NYSE:EC) is the least popular one with only 8 bullish hedge fund positions. Energy Transfer Partners LP (NYSE:ETP) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard BEN might be a better candidate to consider a long position.

Disclosure: none.