We have been waiting for this for a year and finally the third quarter ended up showing a nice bump in the performance of small-cap stocks. Both the S&P 500 and Russell 2000 were up since the end of the second quarter, but small-cap stocks outperformed the large-cap stocks by double digits. This is important for hedge funds, which are big supporters of small-cap stocks, because their investors started pulling some of their capital out due to poor recent performance. It is very likely that equity hedge funds will deliver better risk adjusted returns in the second half of this year. In this article we are going to look at how this recent market trend affected the sentiment of hedge funds towards Apollo Education Group Inc (NASDAQ:APOL) , and what that likely means for the prospects of the company and its stock.

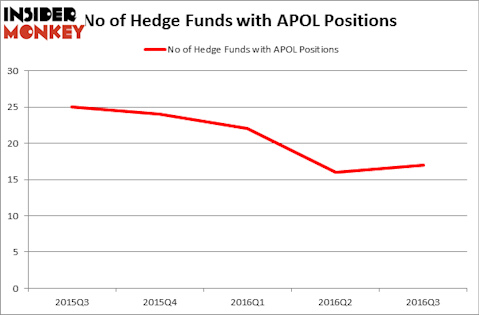

Is Apollo Education Group Inc (NASDAQ:APOL) a safe investment now? The smart money is altogether getting more optimistic. The number of bullish hedge fund positions experienced an increase of 1 lately. APOL was in 17 hedge funds’ portfolios at the end of the third quarter of 2016. There were 16 hedge funds in our database with APOL holdings at the end of the previous quarter. At the end of this article we will also compare APOL to other stocks including PharMerica Corporation (NYSE:PMC), Berkshire Hills Bancorp, Inc. (NYSE:BHLB), and First Busey Corporation (NASDAQ:BUSE) to get a better sense of its popularity.

Follow Apollo Education Group Inc (NASDAQ:APOL)

Follow Apollo Education Group Inc (NASDAQ:APOL)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Sarawut Aiemsinsuk/Shutterstock.com

With all of this in mind, let’s analyze the recent action encompassing Apollo Education Group Inc (NASDAQ:APOL).

How have hedgies been trading Apollo Education Group Inc (NASDAQ:APOL)?

At the end of the third quarter, a total of 17 of the hedge funds tracked by Insider Monkey held long positions in this stock, up 6% from one quarter earlier. By comparison, 24 hedge funds held shares or bullish call options in APOL heading into this year. With hedge funds’ capital changing hands, there exists a select group of notable hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Richard Driehaus’ Driehaus Capital has the largest position in Apollo Education Group Inc (NASDAQ:APOL), worth close to $51.5 million, accounting for 1.7% of its total 13F portfolio. On Driehaus Capital’s heels is Robert Rodriguez and Steven Romick’s First Pacific Advisors LLC which holds a $24 million position. Some other peers that hold long positions comprise Donald Yacktman’s Yacktman Asset Management, D. E. Shaw’s D E Shaw and Gordy Holterman and Derek Dunn’s Overland Advisors. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.