Valuentum Best Ideas Newsletter holding DirecTV (NASDAQ:DTV) is allegedly in advanced talks to close a deal with internet TV provider Hulu. The source asserts that the deal will be in the billion-dollar range. Hulu posted approximately $695 million in revenue in 2012, and people watched 24 billion minutes of entertainment on the service last year. Yet, we at Valuentum do not know what the bottom-line looks like. This valuation is contrary to other tech companies, which have fetched sky-high valuations during the past two years. In fact, it has been rumored that competitor Dish Network Corp (NASDAQ:DISH) bid $1.9 billion for Hulu in 2011, while Google Inc (NASDAQ:GOOG) offered $4 billion with a number of conditional terms that squashed the offer.

The entire pay TV sector, which includes cable companies like Time Warner Inc (NYSE:TWX) and Comcast Corporation (NASDAQ:CMCSA) as well as Dish Network Corp (NASDAQ:DISH) and DirecTV (NASDAQ:DTV), acknowledges that mobile access will be an important part of a well-rounded product offering going forward. Dish Network Corp (NASDAQ:DISH) goes as far as to offer a free Apple Inc. (NASDAQ:AAPL) iPad so subscribers use the hopper—a service that allows consumers to view live TV, on-demand, and DVR recordings from anywhere (shown above). DirecTV (NASDAQ:DTV) offers a similar service in its TV Everywhere, as well as the Genie, which is another service helping drive customer growth. The Genie allows consumers to record 5 shows at the same time, and also lets consumers use one box for an entire house. Comcast Corporation (NASDAQ:CMCSA) has made an effort to compete with TV via its Xfinity On-Demand Streaming service, but its offering isn’t that compelling at this point because it doesn’t offer a full-suite of competition.

On top of the traditional content distributors, we think Hulu competes with Netflix, Inc. (NASDAQ:NFLX) and YouTube. Netflix, Inc. (NASDAQ:NFLX) lacks commercials, but it also does not have a free option. YouTube may not carry as much content from large content creators, but it does have an endless library of other entertaining content. Both YouTube and Netflix can be accessed from the same portals as Hulu.

Cutting the Cord is Overblown…

The obvious benefit Valuentum sees for DirecTV (NASDAQ:DTV) from acquiring Hulu is as a hedge against “cutting the cord.” Cutting the cord is the premise that more consumers are choosing to eliminate cable/satellite TV in favor of competing services like Netflix. However, we think the “cutting the cord” trend is a bit overrated. The US doesn’t quite have the same age demographics as Japan and Europe, but the US still has a tremendously large population of retirees and soon-to-be retirees. For those living on a fixed income, cable/satellite TV offers a tremendous amount of content and entertainment for a relatively low monthly cost. Hulu and Netflix can’t compete with the breadth of content yet.

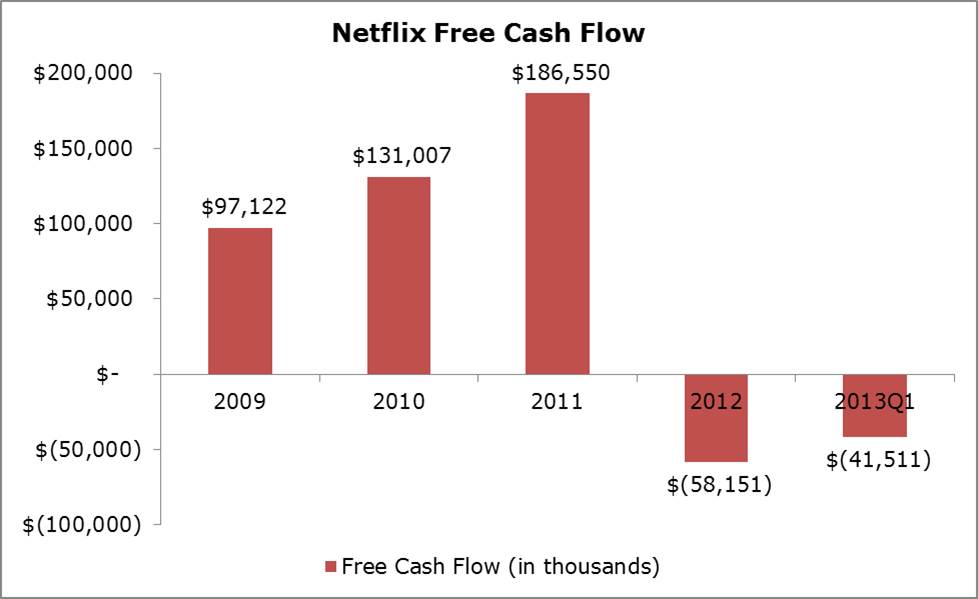

There’s another issue that often doesn’t get mentioned: streaming TV services aren’t very profitable. Netflix has had nice subscriber growth, but it is hardly generating any free cash flow. Netflix’s free cash flow has deteriorated significantly during the previous year.

Source: Netflix, Valuentum

Similarly, we doubt Amazon.com, Inc. (NASDAQ:AMZN)’s Instant Streaming is any more profitable. Neither of these companies has endless pools of capital to tap to keep subsidizing customers for revenue growth. Eventually, prices must increase, or content costs must come down.

…But Hulu is a Nice Hedge against Cutting the Cord.

Still, Hulu is a nice hedge against potential cutting of the cord. Younger generations are arguably more adept at technology and thus more probably more willing to cut cords, but we do not believe the comparable slate of options is robust enough to satisfy the broad scope of consumer tastes. Even if younger consumers do cut cords, we believe a significant portion of entertainment budgets and time will remain related to TV, so Netflix and Hulu would be beneficiaries. TV and Internet TV remain the “path of least resistance” to entertainment, and we doubt anything will interrupt that dynamic in the near-term. Nevertheless, Hulu can help DirecTV (NASDAQ:DTV) make up for lost revenue.

In addition to making a nice hedge against cord cutting, Hulu is better served under the ownership of a larger content distributor, in our opinion. DirecTV (NASDAQ:DTV) already enjoys relationships with the same content creators that own Hulu, giving the combined entity solid bargaining power. Hulu will lose its exclusive streaming agreements, so a bigger, deep-pocketed player like DirecTV will be better-positioned to negotiate deals than companies without existing relationships. Acquiring Hulu would create a fresh marketing angle for full-service DirecTV packages. Hulu also strengthens DirecTV’s TV Everywhere offering, which isn’t as well-known as its competitors’ well-advertised services.

Valuentum’s Take

Although the deal isn’t complete (or officially confirmed), and there is a chance it could fail thanks to regulatory scrutiny or if another bidder emerges, we like the merits of DirecTV purchasing Hulu. Not only could it prevent a competitor from owning Hulu, but Valuentum thinks it makes sense as a part of DirecTV. Hulu generates revenue from a variety of portals that DirecTV currently doesn’t monetize. And, as we stated earlier, consolidation could help return power to the content distributors. The deal also helps insure DirecTV against possible churn from consumers cutting the cord.

The potential acquisition similarly brings us to another possible development: distributor consolidation and/or mergers with content creators. With the various paths to access content, we’ve seen a rush of companies enter the space, rapidly increasing the value of content. However, increases in content costs are quickly reaching a tipping point where it might not make financial sense for distributors to keep paying more, in our view. Netflix previously eschew paying up for exclusive streaming content. Content creators have largely held the leverage over the past few years, but we think distributors could fight back by either refusing to pay or by consolidating.

With content cost increases moderating, or even declining, we think DirecTV is well positioned to generate additional shareholder value. We think Berkshire Hathaway Inc. (NYSE:BRK.A) agrees, as Buffett & Co now owns 6.5% of shares outstanding, increasing its stake 10% quarter-over-quarter.

The article DirecTV Is on the Verge of Acquiring Hulu originally appeared on Fool.com.

RJ Towner has no position in any stocks mentioned. DirecTV is included in Valuentum’s Best Ideas Newsletter portfolio. The Motley Fool recommends DirecTV and Netflix. The Motley Fool owns shares of Netflix. RJ is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.