Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of March. At Insider Monkey, we follow nearly 750 active hedge funds and notable investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is Voyager Therapeutics, Inc. (NASDAQ:VYGR), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

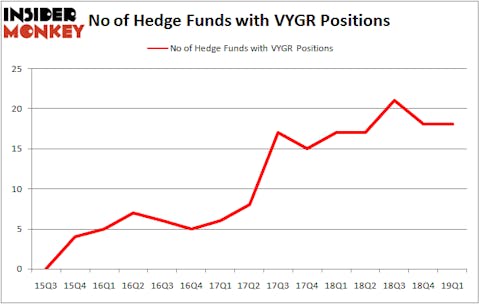

Voyager Therapeutics, Inc. (NASDAQ:VYGR) shares haven’t seen a lot of action during the first quarter. Overall, hedge fund sentiment was unchanged. The stock was in 18 hedge funds’ portfolios at the end of the first quarter of 2019. At the end of this article we will also compare VYGR to other stocks including Eagle Pharmaceuticals Inc (NASDAQ:EGRX), Nova Measuring Instruments Ltd. (NASDAQ:NVMI), and Hanger, Inc. (NYSE:HNGR) to get a better sense of its popularity.

To the average investor there are dozens of metrics market participants employ to size up their holdings. A couple of the less known metrics are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the best picks of the best hedge fund managers can trounce their index-focused peers by a solid amount (see the details here).

We’re going to check out the recent hedge fund action surrounding Voyager Therapeutics, Inc. (NASDAQ:VYGR).

How have hedgies been trading Voyager Therapeutics, Inc. (NASDAQ:VYGR)?

At Q1’s end, a total of 18 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the fourth quarter of 2018. On the other hand, there were a total of 17 hedge funds with a bullish position in VYGR a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Voyager Therapeutics, Inc. (NASDAQ:VYGR) was held by Partner Fund Management, which reported holding $37.3 million worth of stock at the end of March. It was followed by Armistice Capital with a $29.4 million position. Other investors bullish on the company included Casdin Capital, Farallon Capital, and Highline Capital Management.

Since Voyager Therapeutics, Inc. (NASDAQ:VYGR) has faced declining sentiment from hedge fund managers, it’s easy to see that there were a few funds who sold off their entire stakes by the end of the third quarter. Interestingly, Jeffrey Jay and David Kroin’s Great Point Partners sold off the biggest investment of the “upper crust” of funds tracked by Insider Monkey, totaling about $3.4 million in stock. James E. Flynn’s fund, Deerfield Management, also said goodbye to its stock, about $1.1 million worth. These transactions are interesting, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks similar to Voyager Therapeutics, Inc. (NASDAQ:VYGR). These stocks are Eagle Pharmaceuticals Inc (NASDAQ:EGRX), Nova Measuring Instruments Ltd. (NASDAQ:NVMI), Hanger, Inc. (NYSE:HNGR), and Precision Drilling Corp (NYSE:PDS). All of these stocks’ market caps resemble VYGR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EGRX | 23 | 164998 | 2 |

| NVMI | 11 | 105109 | 2 |

| HNGR | 22 | 155181 | 4 |

| PDS | 16 | 36738 | 2 |

| Average | 18 | 115507 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18 hedge funds with bullish positions and the average amount invested in these stocks was $116 million. That figure was $153 million in VYGR’s case. Eagle Pharmaceuticals Inc (NASDAQ:EGRX) is the most popular stock in this table. On the other hand Nova Measuring Instruments Ltd. (NASDAQ:NVMI) is the least popular one with only 11 bullish hedge fund positions. Voyager Therapeutics, Inc. (NASDAQ:VYGR) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on VYGR as the stock returned 17.2% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.