Ric Fulop: We are not €“ that’s as much as we can say about this particular customer. We have several companies we work within consumer electronics, but we are not at liberty to talk in more detail than this

Greg Palm: You mentioned €“ go ahead.

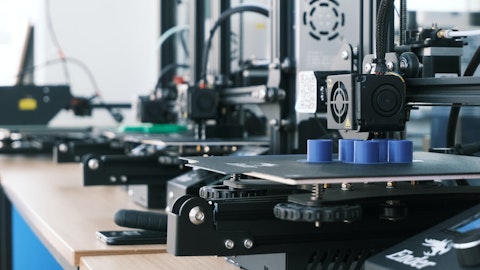

Ric Fulop: No. I mean we have sold millions of dollars of equipment into the consumer electronics space. We have machines around the world at plants that make these types of products today. But it’s an industry where secrecy is important, and we have agreements that don’t allow us to discuss it in any more detail.

Greg Palm: You did mention, I think on an earlier question around P-50 that we might actually hear actual customer names as we progress throughout the year. Were you alluding to the specific opportunity, or is that more of a general comment?

Ric Fulop: Yes. We have several large customers. I have got €“ I can think of two automotive opportunities where I think we will be able to talk about the customer when it ships, and we have other things in development, thermal management opportunity also where it could be possible to perhaps discuss it. We will see. I think we will let our customers do the marketing or I would definitely like to do it. So, let’s see how the year goes and how much we can say as we make progress.

Greg Palm: And the last question around this topic

Ric Fulop: Expanding on that, we have 1,100 metal installations. We have the largest installed base at scale in binder jet, the number one selling products across different categories, whether it’s research, machine shops, production, you name it. And so we €“ I know there is a lot of interest in what we do, particularly in P-50, because it’s a system that’s many times faster than anything else that’s out there. But we have a full portfolio of products. And if you look at our run rate, that’s like $0.25 billion worth of lots of stuff for which a significant portion is binder jet. So, we are the de facto leader in the binder jet space. And I am very happy with our progress in it. And I think that we have technology in this area that nobody else has. We have more engineers working on it than all of our competitors combined. This is a segment that we have complete leadership in.

Greg Palm: Yes. I appreciate that color. And then maybe if I can follow-up on some of the comments around cost cuts, maybe a little bit more color on the progression of that. As we go throughout the year, when you might see the full run rate of those cuts? And then is there a specific level of revenue that you think you can reach EBITDA breakeven at?

Jason Cole: Yes. Thanks for that. So, I think €“ I would think about the €“ let me try to take the first part first. We should have a very meaningful portion of the full 100 in hand midyear. But there are elements of it that will roll out across the second half. But you should see a €“ consistent with our opening remarks, pretty strong improvement entering the second half of the year. And that’s a pretty rapid deployment given the fact we just announced it a month ago, and we are pretty proud of that. But really, there was a sense of urgency for us around really trying to make sure we can control our own destiny. In terms of breakeven, we are positioned to breakeven. We believe we are positioned to breakeven in anywhere across the range we guided by the end of the year.

We believe there are growth drivers. And we believe we will outperform the bottom end of that range. But nevertheless, we put it wide because there are €“ there is uncertainty out there. But we are committed to delivering breakeven results by the end of the year.