We recently published These 10 Stocks are Buzzing After Important Analyst Calls. NVIDIA Corp (NASDAQ:NVDA) is one of the stocks analysts were recently talking about.

Aswath Damodaran, NYU Stern School of Business professor of finance, often known as the “deal of valuation,” recently said in a program on CNBC that he’s still owning a stake in Nvidia, but called the stock “richly priced.” Damodaran said his Intel investment has done better than his Nvidia position.

“I own half of the NVIDIA Corp (NASDAQ:NVDA) that I owned a year ago. And I’m okay with that even though it’s gone up because I think it is so richly priced that I’d rather have my money in Intel than in NVIDIA Corp (NASDAQ:NVDA). And actually my Intel investment’s done better since September of last year than my NVIDIA Corp (NASDAQ:NVDA) investment. Yeah, Intel Intel’s caught a nice wave here.”

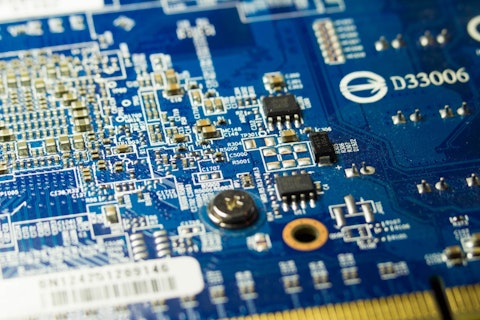

Nvidia’s Hopper Infrastructure and now Blackwell form the core of AI infrastructure for LLM training and inference. But Nvidia’s growth is slowing compared to previous quarters amid competition and capex spending limitations from major companies. In the recently reported quarter, Nvidia’s annual revenue growth came in at 56%, compared with nearly 100% YoY growth in the past.

With its strong position in the data center market and rising demand, Nvidia is likely to keep growing, though not at the same pace it has in the past. Increasing competition from major companies like Broadcom is also expected to impact Nvidia’s margins in the long term.

Nvidia recently impressed the market by signing an AI infrastructure deal with Intel. Nvidia will invest $5 billion in Intel. Jensen Huang said the deal would open up $50B in TAM for both companies in the data center and PC business.

Analysts believe the deal would allow Nvidia to take market share from AMD in the data center and PC business and diversify away from Arm-based designs.

Macquarie Core Equity Fund stated the following regarding NVIDIA Corporation (NASDAQ:NVDA) in its second quarter 2025 investor letter:

“NVIDIA Corporation (NASDAQ:NVDA) performed strongly in the quarter on renewed AI optimism and reduced concern that an individual customer or two will moderate capital expenditures. Though the Fund’s weight was among our largest positions at over 4.5% during the quarter, the relative underweight (the benchmark weight averaged 6.3%) negatively affected relative returns.”

While we acknowledge the risk and potential of NVDA as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than NVDA and that has 10,000% upside potential, check out our report about this cheapest AI stock.

READ NEXT: 30 Stocks That Should Double in 3 Years and 11 Hidden AI Stocks to Buy Right Now.

Disclosure: None. This article is originally published at Insider Monkey.