There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Carl Icahn and George Soros think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other elite funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze Dave & Buster’s Entertainment, Inc. (NASDAQ:PLAY).

Is Dave & Buster’s Entertainment, Inc. (NASDAQ:PLAY) a bargain? Investors who are in the know are betting on the stock. The number of bullish hedge fund bets inched up by 1 recently. At the end of this article we will also compare PLAY to other stocks including Qunar Cayman Islands Ltd (NASDAQ:QUNR), NOW Inc (NYSE:DNOW), and The New York Times Company (NYSE:NYT) to get a better sense of its popularity.

Follow Dave & Buster's Entertainment Inc. (NASDAQ:PLAY)

Follow Dave & Buster's Entertainment Inc. (NASDAQ:PLAY)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Copyright: sainaniritu / 123RF Stock Photo

With all of this in mind, we’re going to view the fresh action encompassing Dave & Buster’s Entertainment, Inc. (NASDAQ:PLAY).

What have hedge funds been doing with Dave & Buster’s Entertainment, Inc. (NASDAQ:PLAY)?

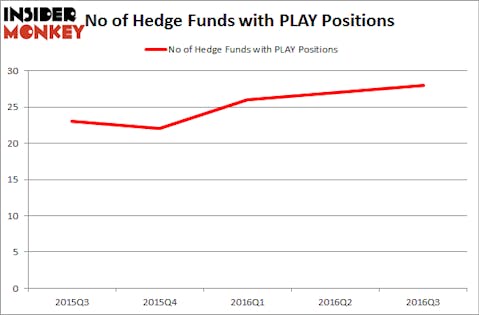

At the end of the third quarter, a total of 28 of the hedge funds tracked by Insider Monkey held long positions in this stock, an increase of 4% from one quarter earlier. Hedge fund ownership of the stock has now trended up for three-straight quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Newbrook Capital Advisors, managed by Robert Boucai, holds the number one position in Dave & Buster’s Entertainment, Inc. (NASDAQ:PLAY). Newbrook Capital Advisors has a $77.5 million position in the stock, comprising 6.9% of its 13F portfolio. Coming in second is Ken Griffin of Citadel Investment Group, with a $64.1 million position. Remaining professional money managers that are bullish encompass Steve Cohen’s Point72 Asset Management, Joel Ramin’s 12 West Capital Management and Gabriel Plotkin’s Melvin Capital Management.

As one would reasonably expect, specific money managers have jumped into Dave & Buster’s Entertainment, Inc. (NASDAQ:PLAY) headfirst. 12 West Capital Management established the largest position in Dave & Buster’s Entertainment, Inc. (NASDAQ:PLAY). 12 West Capital Management had $46.1 million invested in the company at the end of the quarter. James Dinan’s York Capital Management also made a $12.7 million investment in the stock during the quarter. The following funds were also among the new PLAY investors: Dmitry Balyasny’s Balyasny Asset Management, Leon Shaulov’s Maplelane Capital, and Glenn Russell Dubin’s Highbridge Capital Management.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Dave & Buster’s Entertainment, Inc. (NASDAQ:PLAY) but similarly valued. We will take a look at Qunar Cayman Islands Ltd (NASDAQ:QUNR), NOW Inc (NYSE:DNOW), The New York Times Company (NYSE:NYT), and Parkway Properties Inc (NYSE:PKY). This group of stocks’ market caps are similar to PLAY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| QUNR | 7 | 10274 | 0 |

| DNOW | 16 | 227065 | -2 |

| NYT | 23 | 263123 | 1 |

| PKY | 11 | 67753 | -2 |

As you can see these stocks had an average of 14.25 hedge funds with bullish positions and the average amount invested in these stocks was $142 million. That figure was $426 million in PLAY’s case. The New York Times Company (NYSE:NYT) is the most popular stock in this table. On the other hand Qunar Cayman Islands Ltd (NASDAQ:QUNR) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Dave & Buster’s Entertainment, Inc. (NASDAQ:PLAY) is more popular among hedge funds and enticing more and more investors. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None