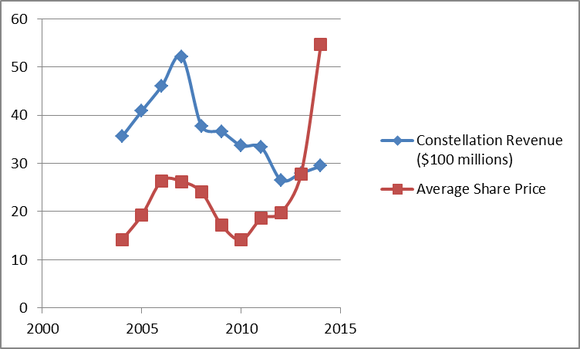

Constellation Brands, Inc. (NYSE:STZ) produces and markets a wide variety of alcoholic beverages, with a list of wine and imported beer brands in its portfolio. What stood out to me about Constellation was that even though revenues have been on a downtrend for some time now, shares are up tremendously. In fact, over the past year alone, shares have tripled and are not at their highest level ever. Why are investors so optimistic about this one? Should shareholders take their incredible gains and get out, or is there reason to believe that there is even more upside ahead?

About Constellation Brands

Constellation operates its business in two divisions: Constellation Wine and Crown Imports. Constellation Wine produces and markets a wide variety of wines in the U.S., Canada, U.K, Australia, and New Zealand. The company also exports its wines to other regions of the world. Among the long list of brand names the company owns are Robert Mondavi, Franciscan Estate, Toasted Head, Clos du Bois, Arbor Mist, and Blackstone, just to name a few.

Crown Imports is Constellation’s joint venture with Grupo Modelo, under which each company has an equal interest in Modelo’s brands. Crown imports, markets, and sells such popular brands as Corona, Modelo Especial, and Pacifico.

The Pessimism Turned Into Optimism

Up until this past year, Constellation traded in single-digit P/E multiples, and seemed to be in a range of $15-22 per share for a few years. Now, with shares above $50 and a P/E of about 25 times TTM earnings, the market’s general pessimism about the company has turned into optimism. Granted, up until 2011, Constellation had a shaky history of profitability, and now the company has established a pattern of earnings. One of the things that I notice that changed is the five consecutive years of declining revenues reversed itself over this past year, which looks to have shifted the sentiment.

Following this trend, Constellation’s sales are projected to rise at a moderate 3-5% annually for the next few years, but margins are projected to rise significantly. For the current fiscal year, Constellation is expected to earn $2.78 per share, up from $2.19 last year. This is expected to grow further to $3.51 and $4.05 over the next couple of years. This equates to an annual average earnings growth rate of 22.9%. No wonder investors are optimistic.

As far as other ways to play the sector go, my two favorite alcoholic beverage plays are Molson Coors Brewing Company (NYSE:TAP) and Diageo plc (ADR) (NYSE:DEO).

Molson Coors: The Beer Play

MolsonCoors is one of the largest beer companies in the world, with such brands as Coors Lite, Molson Canadian, Killian’s, Blue Moon, and Keystone, just to name a few. While the alcoholic beverage trend over the past few years has been away from beer and towards wine and spirits, Molson Coors’ brands have outperformed the overall U.S. beer market, especially craft brands such as Blue Moon.

At right around 13 times last year’s earnings, shares seem fairly valued at the current price, especially considering that the consensus only calls for annual earnings growth of 7% going forward. Molson Coors does pay a nice dividend yield of 2.55%, which is definitely worthy of consideration if income is a priority.

Diageo: For Those Who Prefer Liquor

Diageo is a diverse producer of alcoholic beverages, with such brands as Smirnoff, Johnnie Walker, Baileys, Captain Morgan, and Jose Cuervo. Diagio has been growing at double-digit rates in emerging markets, which are very significant because they make up over 40% of Diageo’s business. This is offset by lagging growth rates in the company’s developed markets, especially Europe.

At 18.5 times TTM earnings, it looks a little cheaper than Molson, and pays a similar dividend yield. Diageo is also projected to grow its earnings at a 7% annual rate going forward, which is due to a combination of the slow domestic and European growth, and the above-average emerging markets growth rate.

Buy, Sell, or Hold?

After the tremendous gains in share price over the past year, it would almost be silly to not consider selling at least some of your position and taking some gains. Regardless of what you think the stock will do over the next few years, there is never anything wrong with selling a position because you tripled your money. What a good problem to have!!

However, hanging on to some of your holdings may be a good idea, especially if you believe that Constellation will meet its lofty earnings growth projections over the next few years.

Matthew Frankel has no position in any stocks mentioned. The Motley Fool recommends Diageo plc (NYSE:DEO) (ADR) and Molson Coors Brewing (NYSE:TAP) Company.

The article This Wine Distributor Tripled Last Year; Should You Sell or Hold? originally appeared on Fool.com.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.