The Department of Energy on Friday approved a second LNG export terminal for exports to non-free trade agreement counties, the Freeport LNG terminal operated by ConocoPhillips (NYSE:COP) and Michael Smith. This is the first terminal approved in two years and, hopefully, for those on the waiting list, this is the start of a trend with others being approved shortly. Export approvals are promising for natural gas producers in the medium term in that they should help put a floor under natural gas prices and demand, thus sparking drilling activity in the sector.

If you aren’t familiar with what’s been going on in the natural gas world, check out this article “The U.S. Natural Gas Story in 15 Charts.”

The Department of Energy had approved just one export terminal for exports to non-free trade agreement countries, Cheniere Energy Partners LP (NYSEMKT:LNG)’s Sabine Pass Terminal in May 2011. Before approving any more, the Department of Energy commissioned reports to study the effects of approving any more terminals, as the DOE has responsibility to make sure new terminals do not “subsequently lead to a reduction in the supply of natural gas needed to meet essential domestic needs.” Chemical companies, especially The Dow Chemical Company (NYSE:DOW), have been major opponents of the U.S. exporting natural gas as they want to benefit from the artificially low prices resulting from the U.S.’ inability to export natural gas. While the studies were going through, applications built up. All are approved for export to countries with which the U.S. has free trade agreements (FTA), but the DOE needs to approve each one individually for export to non-FTA countries.

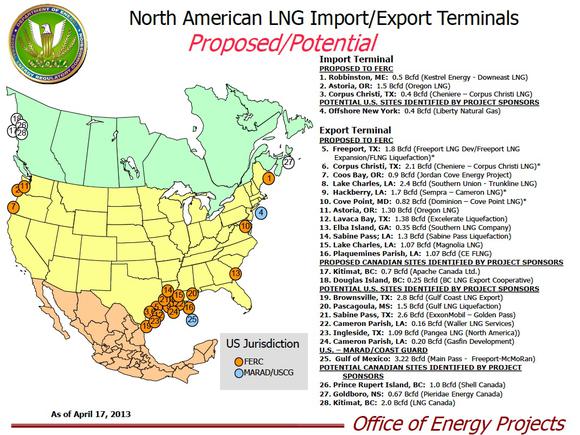

The DOE now has 24.94 bcf/d of potential export capacity waiting to be approved. Exports are a massive opportunity for the U.S. as there is such a large gap between U.S. and world LNG prices. For the past few years, low natural gas prices have been crushing natural gas producers. With the downturn, many producers have followed SandRidge Energy Inc. (NYSE:SD)’s lead in shifting to drilling for oil while others, most notably Chesapeake Energy Corporation (NYSE:CHK), have had to resort to selling off natural gas assets to make ends meet.

Producers are thus excited by the DOE’s conditional approval of Freeport LNG’s export terminal, which would hopefully be the start of more approvals. Also potentially excited is Dow Chemical, which appears to have hedged its bets a bit as Dow is a limited partner in the Freeport LNG project. The Freeport LNG terminal is approved for up to 1.4 bcf/d of exports. This brings total approved export capacity in the lower 48 states up to 3.6 bcf/d. With this conditional approval it will still take years for the terminal to get up and running. The terminal first needs authorization from FERC to begin construction, and then, once started, it is expected that the terminal would take four to five years to build.

While the approval doesn’t mean much in the short run, in five years or so exports should boost the prices natural gas producers receive for their natural gas. Expected cash flows play a big part in determining estimated stock price valuations after being discounted back to the present using an appropriate risk-adjusted cost of capital. Therefore, as approvals roll in, valuations for those involved are almost certain to rise.

There are many different ways to play the energy sector, and The Motley Fool’s analysts have uncovered an under-the-radar company that’s dominating its industry. This company is a leading provider of equipment and components used in drilling and production operations, and poised to profit in a big way from it. To get the name and detailed analysis of this company that will prosper for years to come, check out the special free report: “The Only Energy Stock You’ll Ever Need.” Don’t miss out on this limited-time offer and your opportunity to discover this under-the-radar company before the market does. Click here to access your report — it’s totally free.

The article Another Giant Leap for Natural Gas Exports originally appeared on Fool.com and is written by Dan Dzombak.

Dan Dzombak can be found on Twitter @DanDzombak or on his Facebook page, DanDzombak. He has no position in any stocks mentioned. The Motley Fool has the following options on Chesapeake Energy: long Jan. 2014 $20 calls, long Jan. 2014 $30 calls, and short Jan. 2014 $15 puts. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.