The successful funds run by legendary investors such as Dan Loeb and David Tepper make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentive to do the research necessary to beat the market. That’s why we pay close attention to what they think in small cap stocks. In this article, we take a closer look at CoLucid Pharmaceuticals Inc (NASDAQ:CLCD) from the perspective of those successful funds.

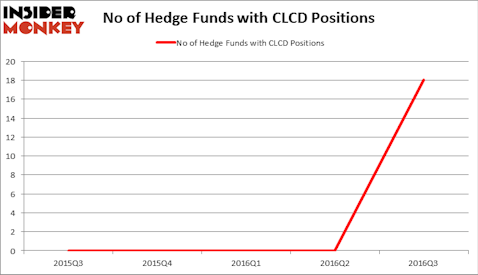

CoLucid Pharmaceuticals Inc (NASDAQ:CLCD) shareholders have witnessed an increase in hedge fund interest between July and September. In fact, at the end of the previous quarter, none of the funds from our database had held shares of the company. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Sanchez Energy Corp (NYSE:SN), Angie’s List Inc (NASDAQ:ANGI), and M/I Homes Inc (NYSE:MHO) to gather more data points.

Follow Colucid Pharmaceuticals Inc. (NASDAQ:CLCD)

Follow Colucid Pharmaceuticals Inc. (NASDAQ:CLCD)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

wavebreakmedia/Shutterstock.com

How are hedge funds trading CoLucid Pharmaceuticals Inc (NASDAQ:CLCD)?

At Q3’s end, a total of 18 of the hedge funds tracked by Insider Monkey were long CoLucid Pharmaceuticals. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who accumulated the largest stakes.

According to Insider Monkey’s hedge fund database, Mark Lampert’s Biotechnology Value Fund / BVF Inc has the largest position in CoLucid Pharmaceuticals Inc (NASDAQ:CLCD), worth close to $29.1 million, comprising 5.5% of its total 13F portfolio. The second most bullish fund manager is Perceptive Advisors, led by Joseph Edelman, holding a $21.1 million position; the fund has 1.4% of its 13F portfolio invested in the stock. Some other peers with similar optimism encompass Jeffrey Jay and David Kroin’s Great Point Partners, Phill Gross and Robert Atchinson’s Adage Capital Management, and Paul Marshall and Ian Wace’s Marshall Wace LLP. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

On the next page, we’ll compare CoLucid Pharmaceuticals’ popularity with the sentiment towards other stocks with similar market caps.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as CoLucid Pharmaceuticals Inc (NASDAQ:CLCD) but similarly valued. These stocks are Sanchez Energy Corp (NYSE:SN), Angie’s List Inc (NASDAQ:ANGI), M/I Homes Inc (NYSE:MHO), and Bojangles Inc (NASDAQ:BOJA). This group of stocks’ market valuations resemble CLCD’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SN | 12 | 64128 | 0 |

| ANGI | 11 | 76703 | 0 |

| MHO | 9 | 51021 | 1 |

| BOJA | 10 | 12231 | 3 |

As you can see these stocks had an average of 11 funds with bullish positions and the average amount invested in these stocks was $51 million, versus $119 million in CLCD’s case. Sanchez Energy Corp (NYSE:SN) is the most popular stock in this table, while M/I Homes Inc (NYSE:MHO) is the least popular one with only nine funds having reported long positions. Compared to these stocks CoLucid Pharmaceuticals Inc (NASDAQ:CLCD) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: none