Colgate-Palmolive Company (NYSE:CL), together with its subsidiaries, manufactures and markets consumer products worldwide. The company operates in two segments: Oral, Personal and Home Care; and Pet Nutrition. This dividend king has paid dividends since 1895 and has increased them for 54 years in a row.

The company’s latest dividend increase was announced in March 2017 when the Board of Directors approved a 2.60% increase in the quarterly annual dividend to 40 cents/share. This was the slowest rate of dividend increases since 1980 (1). It indicates that the company’s management is cautious about Colgate-Palmolive’s near term business outlook.

Copyright: mozakim / 123RF Stock Photo

The company’s peer group includes Procter & Gamble Co (NYSE:PG), Clorox Co (NYSE:CLX), and Kimberly Clark Corp (NYSE:KMB).

Over the past decade this dividend growth stock has delivered an annualized total return of 11.50% to its shareholders.

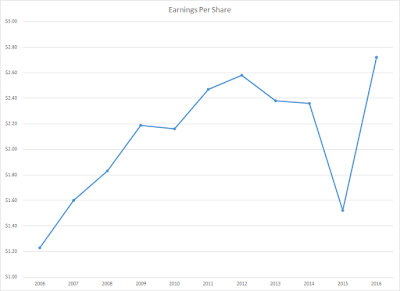

The company has managed to deliver an 8.20% average increase in annual EPS over the past decade. Colgate-Palmolive Company (NYSE:CL) is expected to earn $2.92 per share in 2017 and $3.17 per share in 2018. In comparison, the company earned $2.72/share in 2016. The hit to earnings in 2015 was from an accounting charge related to Colgate-Palmolive’s Venezuela operations. From a dividend growth investor point of view, the lack of earnings per share growth since 2011/2012 is something of an issue that needs to be monitored. The strong US dollar is one of the reasons to blame. Without further growth in earnings per share, future dividend growth will be severely limited, and intrinsic value will not grow (2).

In general, earnings per share will increase through emerging market sales growth, share buybacks, cost restructurings, strategic acquisitions and new product introductions.

Earnings per share have been aided by regular share buybacks. Between 2004 and 2016, the number of shares decreased from 1,135 million to 898 million.

The growing emerging markets in Latin America and Asia and the rising middle class in these markets could present an excellent opportunity for Colgate-Palmolive Company (NYSE:CL). Colgate generates over 75% of its sales from outside of the US. Latin America accounts for one third of sales, while Asia/Africa accounts for over one fifth of sales. The issue with overexposure to emerging markets is that they can be prone to currency devaluations, which could impact profitability. The strong dollar has pressured earnings and revenues in the past couple of years by pretty significant amounts. Another issue could come from rising commodity costs, which could pressure margins and profitability despite expectations for rising volumes. Given the strong brand names of many of Colgate’s products however, the company could mitigate this by passing on cost increases to consumers.

Follow Colgate Palmolive Co (NYSE:CL)

Follow Colgate Palmolive Co (NYSE:CL)

Receive real-time insider trading and news alerts