The largest futures exchange in the world, CME Group Inc (NASDAQ:CME) came to be in 2007, when the Chicago Mercantile Exchange and CBOT holdings merged. Anyone who invests regularly (or watches CNBC, for that matter) can tell you how relevant futures and options have become over the past decade or so. All of the major discount brokerages have begun offering futures trading to those clients who are adventurous enough to trade them!

Company Profile

CME offers a diverse range of futures and options-on-futures products, using both its CME Globex trading platform and trading floors. They offer futures in four primary areas: interest rates, stock indexes, foreign exchange, and commodities.

The company also operates its own clearing house, which settles and guarantees every contract traded through the exchange, a huge competitive advantage since this allows the company to earn revenue from both trading and clearing. CME gets 83% of its revenues from fees directly from trading and clearing, with the remainder coming from its auction markets, private transactions, and its clearing services for OTC transactions.

Earnings and Valuation

CME has demonstrated consistent earnings growth as revenues have increased, with only one year of negative earnings growth (2009). When the company reports next week, they are expected to report $3.03 per share, and the consensus calls for this to increase to $3.24 and $3.70 in 2013 and 2014, respectively.

So, even though the stock trades at around 19 times earnings, with a forward average earnings growth rate of 10.6%, I believe this valuation is well deserved. For comparison’s sake, let’s take a look at two other publicly traded exchanges, Intercontinental Exchange and NASDAQ.

Intercontinental Exchange, who just agreed to purchase NYSE Euronext, is the leading global soft commodity futures exchange, so business-wise it is actually quite similar to CME. The stock trades at 17.7 times earnings, slightly less than CME; however, the earnings growth predicted is slightly less. There is also a certain element of risk in getting the NYSE deal approved, as the company is devoting a large portion of its resources to making it happen. That being said, ICE does seem like a fairly-valued investment, given the added uncertainty.

NASDAQ OMX Group, Inc. (NASDAQ:NDAQ) provides trading, exchange technology, and securities listing services. The stock trades at just 14 times earnings, which may seem like a bargain at first, however I’m not so sure. NASDAQ’s earnings and revenues are relatively unpredictable. Trading volumes can fluctuate wildly, and in the most recent quarter, volumes were down a full 20% from the quarter before.

Dividends

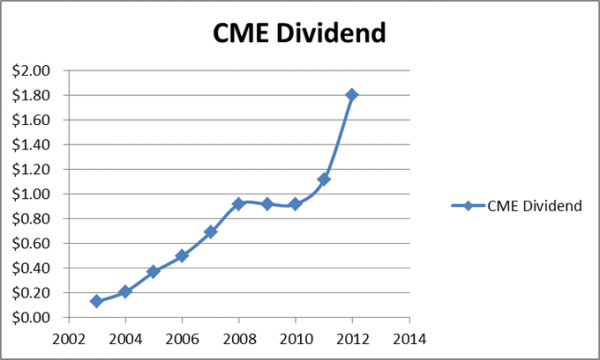

CME Group has paid a dividend every year since 2003 and has increased it regularly, from 13 cents per share in 2003 to $1.80 currently, or a yield of 3.12%. I would be very surprised if there wasn’t another increase this year. Something in the $2.00 per share range is what I would expect.

I believe CME is a fairly valued company in arguably the fastest growing segment of the financial services industry (futures and options). More important than the earnings numbers themselves will be the company’s outlook for the future, i.e., is the growth in futures trading volumes going to continue?

The article CME Group: Will Futures Keep Gaining Popularity? originally appeared on Fool.com and is written by Matthew Frankel.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.