We came across a bullish thesis on Cloudflare, Inc. on Northwest Frontier Capital’s Research’s Substack by Northwest Frontier Capital. In this article, we will summarize the bulls’ thesis on NET. Cloudflare, Inc.’s share was trading at $193.20 as of August 20th. NET’s forward P/E was 222.22 respectively according to Yahoo Finance.

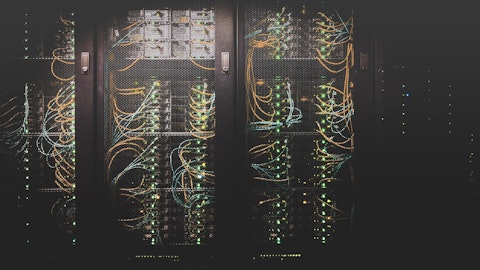

Photo by Austin Distel on Unsplash

Cloudflare delivered a strong Q2 2025, surpassing expectations on revenue and EPS, with revenue of $512.3 million up 28% YoY and operating profit and free cash flow also ahead of estimates. Growth accelerated for the first time in several quarters, driven by large customer momentum, with $100k+ customers up 22% and revenue from that cohort growing 35%. A highlight was a $15 million Workers AI contract from a fast-growing AI firm migrating workloads from a hyperscaler, exemplifying Cloudflare’s ability to win major AI deals, expand relationships, and move upmarket toward enterprise-scale contracts.

CEO Matthew Prince outlined a strategy to capture massive enterprise workloads away from hyperscalers, positioning Cloudflare for 7-, 8-, and eventually 9-figure deals. The “Pool of Funds” contract model also turned into a growth driver, fueling a jump in Dollar-Based Net Retention to 114% as consumption accelerated, confirming the strategy’s effectiveness. Beyond near-term growth, Prince detailed “Act 4,” Cloudflare’s vision to become the transaction layer for the agentic AI economy, leveraging its global network and Workers platform to authenticate and process microtransactions at scale. This ambition underscores the company’s long-term optionality, adding to immediate tailwinds in SASE, AI inference, and enterprise adoption.

While the stock’s valuation remains high at over 30x EV/Sales, the breadth of structural growth drivers—expanding markets, accelerating customer momentum, and optional exposure to AI commerce—makes Cloudflare one of the few platform companies capable of sustaining long-term growth at scale. Execution remains the key risk, but Q2 showed mounting evidence of a new phase of acceleration, with the company well positioned to join the ranks of technology’s $100 billion giants.

Previously, we covered a bullish thesis on Cloudflare, Inc. (NET) by Oliver | MMMT Wealth in April 2025, which highlighted its network effects, 20%+ growth outlook, and expected profitability inflection in 2025. The company’s stock has appreciated about 80% since then as growth drivers materialized. Northwest Frontier Capital shares a similar view but emphasizes Q2 2025 results, AI contracts, and “Act 4.”

Cloudflare, Inc. is not on our list of the 30 Most Popular Stocks Among Hedge Funds. As per our database, 65 hedge fund portfolios held NET at the end of the first quarter which was 55 in the previous quarter. While we acknowledge the risk and potential of NET as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than NET and that has 10,000% upside potential, check out our report about this cheapest AI stock.

READ NEXT: 8 Best Wide Moat Stocks to Buy Now and 30 Most Important AI Stocks According to BlackRock.

Disclosure: None.