When disaster strikes, chances are Clean Harbors Inc (NYSE:CLH) will be on their way. Clean Harbors provides emergency response environmental, energy, and industrial cleanup services as well as natural disaster relief and cleanup worldwide. They also provide recycling, chemical packaging, and other uniquely positioned services. This company currently has Waste Management, Inc. (NYSE:WM) facilities in the United States, China, the United Kingdom, Canada, Puerto Rico, Bulgaria, Singapore, Thailand, and Sweden. These locations are important to note because a worldwide presence is key to providing cleanup services no matter where a disaster happens.

Hurricane Sandy wreaked havoc on the northeastern United States a few weeks back. When this disaster struck, America knew it would need the help from the same company who assisted with Hurricane Katrina and Hurricane Rita in 2005: Clean Harbors. This kind of reputation is strong for the company going forward. Disasters such as these also cause a temporary spike in the number of employees Clean Harbors has. I am not saying that a disaster is a good thing for the economy, but at least there is something positive to come of it. Hurricanes Sandy, Katrina, and Rita all took about 500 clean up personnel, while the BP oil spill required over 3,500. Clean Harbors utilizes its resources efficiently.

Clean Harbors has differentiated themselves from ordinary waste management and disposal companies. Waste Management, Inc. (NYSE:WM) provides collection, recycling, transfer, and disposal services. They also operate landfills, waste-to-energy facilities, and have been active in supporting the switch to natural gas vehicles in America. Needless to say, Waste Management has a great image and is a strong company in this space, but they do not have a major disaster relief branch, so they are not a threat to Clean Harbors yet. If they were to enter the disaster relief space, they have the potential to become the worldwide leader overnight.

Veolia Environnement Ve SA (ADR) (NYSE:VE) provides water services, waste management, energy services, and both industrial and public transportation services. They are located in 77 countries including the United States, giving them a major worldwide presence. Veolia is much like Waste Management, but also has a natural disaster relief program like Clean Harbors, posing a threat. They specialize in cleanup after hurricanes, tornadoes, floods, and the other areas Clean Harbors specializes in. I see Veolia as the top competitor to Clean Harbors, but neither company will be able to put the other out of business.

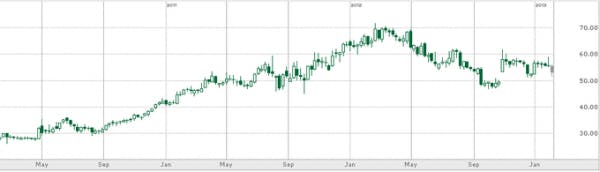

Clean Harbors is currently trading around 26.5 times earnings and 18.4 times forward earnings. With the Hurricane Sandy relief ongoing, I believe Clean Harbors can increase their 2013 outlook and send shares higher. However, when there is a dry spell of natural disasters Clean Harbor’s (NYSE:CLH) earnings take a hit. This stock is currently down over 17.5% in the last 52 weeks, so there is definitely plenty of room to run. I see this one reaching $60 per share in 2013, and have therefore made an outperform call on CAPS. Clean Harbors is a BUY.

The article Cleanliness is Next to Godliness originally appeared on Fool.com and is written by Joseph Solitro.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.