The second half of April saw record setting bond sales Hong Kong and New York. Asia’s leading oil refiner, China Petroleum & Chemical Corp (ADR) (NYSE:SNP) (Sinopec), sold $3.5 billion, which was not only the biggest bond sale by a Chinese company in the last ten years, but also the single largest sale in Asia, excluding Japan. Two weeks later, CNOOC Limited (ADR) (NYSE:CEO) announced an even bigger bond sale worth $4 billion. With the low yields in the U.S., Chinese corporate bonds are more attractive than ever.

According to data provided by Dealogic in 2012, Chinese issuers raised a total of $476 billion out of the $881 billion coming from Asia (excluding Japan), or 54% of the total. The comparable number so far this year from Chinese firms has been $170 billion, or 58% of the total $293 billion raised. Through the end of April, Chinese firms raised $51.7 billion more than in the first four months of 2012.

The demand for these instruments, particularly in the sluggish economies of the U.S. and Europe, is extremely high as investors are looking for a greater exposure towards the high yielding and quickly maturing bond markets of the East.

Meanwhile, the governments of the emerging markets have been reluctant to issue bonds as they implement tighter controls over their fiscal policy as they attempt to fight the exporting of inflation engendered by the quantitative easing of the Federal Reserve, Bank of Japan, and Bank of England. With a thin supply of government securities, the demand for corporate bonds has risen even more. As a result, each tranche of bond issuance coming from emerging markets is guaranteed to be oversubscribed.

Both of these bond issuances, Sinopec and CNOOC Limited (ADR) (NYSE:CEO), were dollar denominated. They represent a total of $9.5 billion while investors wanted significantly more. China Petroleum & Chemical Corp (ADR) (NYSE:SNP)’s offer was four times oversubscribed. Similarly, CNOOC’s issuance attracted $23.8 billion of orders, just 16 hours after the announcement attracting those investors as well who missed out on Sinopec’s deal, particularly from the U.S.

This meant that the dons wound up selling at depressed yields given the very low yields in the West because of monetary policy forcing down the entire yield curve for U.S. and Japanese securities, and the Chinese bonds are still more attractive for U.S investors than Treasury bills. Moreover, even U.S. corporate bonds are a crowded trade.

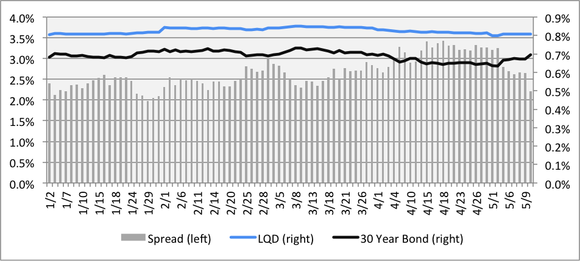

The iShares iBoxx $ Invest Grade Corp Bond ETF (NYSEMKT: LQD) is trading at just a current yield of 3.60% and is continually bid higher anytime the spread between it and 30-year Treasury Bonds rises above 0.70%. Junk bonds in the U.S. are carrying less than 5% yield. It is only natural for investors to jump at the chance to invest in something where everyone else isn’t. CNOOC Limited (ADR) (NYSE:CEO)’s $500 million 30-year bonds were sold at 150 basis points over comparable Treasury yields.

More than 60% of CNOOC’s offering was taken up by American investors, around 25% by their fellow Asians, while the remaining went to Europe. On the other hand, China Petroleum & Chemical Corp (ADR) (NYSE:SNP) raised most of its debt from Asian buyers and about one-third from U.S investors.

Sinopec needs cash as it has been purchasing assets from its parent China Petrochemical. Some of the debt will also be used to pay short-term loans. Similarly, CNOOC Limited (ADR) (NYSE:CEO) acquired the Canadian energy firm Nexen in a $15.1 billion deal last year and it will use the debt to fund the takeover.

In the last six months, China Petroleum & Chemical Corp (ADR) (NYSE:SNP)’s ADR has risen 1% while CNOOC is down 10.7%. Sinopec recently posted strong results in its quarter where its profits jumped 25% to $2.7 billion as its refining operation became profitable. On the other hand, CNOOC reported a 9.3% drop in annual profits on March 22 but its pipeline is extremely strong, with a reserve replacement ratio of 188% in 2012, up from 158% in 2011, and that does not include Nexen’s figures. China Petroleum & Chemical Corp (ADR) (NYSE:SNP) is slightly more expensive than CNOOC Limited (ADR) (NYSE:CEO) at the moment, but it offers a strong yield of more than 5% along with a much more profitable refining business with the overhauling of China’s fuel pricing scheme.

| Sinopec | CNOOC | |

|---|---|---|

| P/E | 9.7 | 8.2 |

| EPS | 11.3 | 22.6 |

| Yield | 5.3% | 4.00% |

| ROA | 5.0% | 12.8% |

| ROE | 12.7% | 22.2% |

Sinopec looks to be the stronger of the two firms here with the liberalization of diesel and petrol pricing allowing for increased refining margins and its aggressive foreign investment moves around the region, Sinopec should see return on assets rise significantly in 2014. While China’s economy may be slowing down somewhat, its petroleum usage is still growing at twice the rate as the rest of the world with auto sales up strongly so far in 2013, so refining margins will not only improve for Sinopec because of legislation, but it’s building a portfolio of upstream assets will cut its costs in the long run.

Peter Pham has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Peter is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

The article Chinese Oil Majors Create Smörgåsbord for Bond Investors originally appeared on Fool.com and is written by Peter Pham.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.