Loomis Sayles, an investment management company, released its “Small Cap Value Fund” second-quarter 2025 investor letter. A copy of the letter can be downloaded here. US equities significantly rallied in the second quarter amid tariff and trade concerns and geopolitical events. The fund returned 5.40% compared to 4.97% for the Russell 2000® Value Index due to positive allocation effects across multiple sectors. In addition, please check the fund’s top five holdings to know its best picks in 2025.

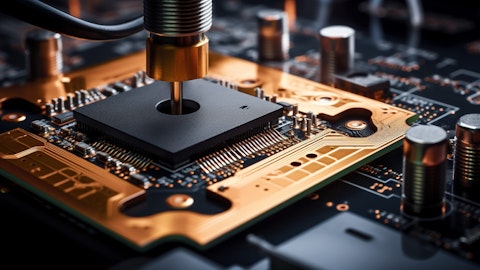

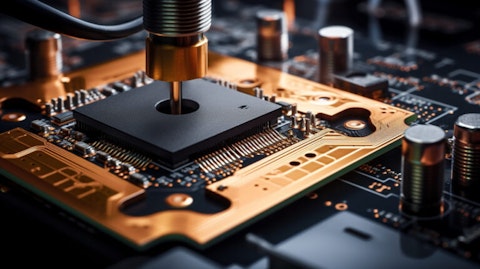

In its second-quarter 2025 investor letter, Loomis Sayles Small Cap Value Fund highlighted stocks such as TTM Technologies, Inc. (NASDAQ:TTMI). TTM Technologies, Inc. (NASDAQ:TTMI) engages in the manufacturing and distribution of mission systems, radio frequency (RF) components, and RF microwave/microelectronic assemblies, and printed circuit boards (PCBs). The one-month return of TTM Technologies, Inc. (NASDAQ:TTMI) was 6.99%, and its shares gained 155.56% of their value over the last 52 weeks. On September 03, 2025, TTM Technologies, Inc. (NASDAQ:TTMI) stock closed at $46.23 per share, with a market capitalization of $4.776 billion.

Loomis Sayles Small Cap Value Fund stated the following regarding TTM Technologies, Inc. (NASDAQ:TTMI) in its second quarter 2025 investor letter:

“TTM Technologies, Inc. (NASDAQ:TTMI) is the largest US-domiciled supplier of printed circuit boards, a foundational component for many electronic products. The company has been on a multi-year journey to improve revenue quality and increase margins through factory consolidation. While progress has required patience on the part of investors, the initiatives have begun to show success and accelerated in the second quarter. At the same time, strength in legacy end markets such as Aerospace and Defense as well as new demand from computer servers for AI applications, drove robust revenue growth and raised investors prospects for future growth. The fund continues to hold an investment in TTM Technologies, given an attractive valuation, improving revenue visibility and further opportunities to increase margins.”

TTM Technologies, Inc. (NASDAQ:TTMI) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 40 hedge fund portfolios held TTM Technologies, Inc. (NASDAQ:TTMI) at the end of the second quarter, which was 36 in the previous quarter. TTM Technologies, Inc. (NASDAQ:TTMI) net sales were $730.6 million in Q2 2025 compared to $605.1 million in Q2 2024. While we acknowledge the risk and potential TTM Technologies, Inc. (NASDAQ:TTMI) as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than TTM Technologies, Inc. (NASDAQ:TTMI) and that has 10,000% upside potential, check out our report about this cheapest AI stock.

In another article, we covered TTM Technologies, Inc. (NASDAQ:TTMI) and shared the list of hot mid cap stocks to buy. In addition, please check out our hedge fund investor letters Q2 2025 page for more investor letters from hedge funds and other leading investors.

READ NEXT: The Best and Worst Dow Stocks for the Next 12 Months and 10 Unstoppable Stocks That Could Double Your Money.

Disclosure: None. This article is originally published at Insider Monkey.