These costs are widely expected to continue rising in 2013, but a recent decline in corn and soybean prices could reduce the costs of chicken feed and chickens, while a dip in oil prices, caused by a surplus in the United States and lower demand from China, could reduce transportation costs.

By raising menu prices during the quarter, Chipotle was able to preserve its margins and profits at the expense of sales volume. Meanwhile, McDonald’s took the opposite approach, using an aggressive value menu strategy to gain market share at the expense of leaner margins.

Margins and expenses

Despite these efforts, Chipotle’s restaurant level operating margin (total revenue minus restaurant operating costs) still declined 110 basis points year-on-year to 26.3%. Total operating margins, however, rose 50 basis points due to reduced expenses. Chipotle Mexican Grill, Inc. (NYSE:CMG) decreased its SG&A (sales, general and administrative) expenses from the previous year, although occupancy costs rose to 6.6% of total revenue.

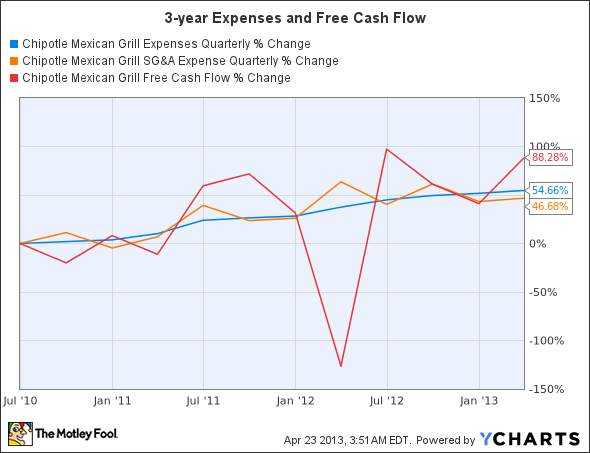

Although these improvements are encouraging, the following chart shows that Chipotle’s long-term uptrend in expenses still appears intact.

Rising expenses, especially occupancy costs, will likely keep rising, especially since Chipotle intends to open 165 to 180 new restaurants in 2013.

Chipotle also finished the quarter with a strong cash position of $346.9 million, up from $322.6 million in the prior year quarter. Chipotle also repurchased $51 million in shares during the quarter, and added $100 million to its current share repurchase program.

The Bottom Line

A big issue that fundamental investors have with Chipotle is its high P/E. Compared to McDonald’s, Yum! Brands or Panera, it is trading at a high premium.

Chipotle’s trailing P/E has come down considerably since early 2012, yet its price seems to be trending back toward its all-time highs. That means that Chipotle Mexican Grill, Inc. (NYSE:CMG)’s share price is gradually reconciling with its high P/E ratio, a positive sign that the company’s growth is sustainable.

A look at its fundamentals, compared to McDonald’s, Yum! and Panera, reveals a fairly mixed picture, however.

| Forward P?E | 5-year PEG | Price to Sales (ttm) | Return on Equity (ttm) | Debt to Equity | Profit Margin | |

| Chipotle | 29.19 | 1.68 | 3.98 | 23.75% | No debt | 10.36% |

McDonald’s | 15.74 | 2.04 | 3.61 | N/A | 89.14 | 19.79% |

Yum! Brands | 17.40 | 1.89 | 2.16 | 76.06% | 127.25 | 11.71% |

Panera Bread | 21.93 | 1.35 | 2.46 | 23.49% | 0.81 | 8.14% |

Advantage | McDonald’s | Panera | Yum! Brands | Yum! Brands | Chipotle | McDonald’s |

Source: Yahoo Finance April 23

Although McDonald’s is the cheapest fundamentally, it is also the slowest growing one of this group. The company is weighed down by endless troubles in Europe, which account for roughly 40% of its top line, and faces difficulties expanding in China under the shadow of Yum! Brands. Meanwhile, Yum! had a great run, but an endless stream of bad news in China — macroeconomic declines, chemically tainted chicken and the avian flu — all point to tough times ahead for the KFC parent.

That means Chipotle and Panera, two ‘bistro fast food’ establishments, are more likely to benefit from more limited global exposure than its larger rivals. A growing preference for healthier fast food should also help these two companies outperform their larger rivals over the next few years.

However, Chipotle’s anemic same-store sales growth and cautious outlook for 2013 suggests that investors shouldn’t be in a hurry to pick up shares, as any big market swoon will likely present a better entry point than current prices.

The article Can Chipotle Keep Climbing in 2013? originally appeared on Fool.com and is written by Leo Sun.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.