Aristotle Capital Management, LLC, an investment management company, released its “Global Equity Strategy” first quarter 2025 investor letter. A copy of the same can be downloaded here. Global equity markets experienced a negative Q1 return, while global fixed income grew. Value stocks outpaced growth, with the MSCI ACWI Value Index outperforming the Growth Index by 11.59%. Aristotle Capital Global Equity Strategy returned 1.12% gross of fees (1.02% net of fees) in the first quarter, outperforming the MSCI ACWI Index’s -1.32% return and the MSCI World Index’s -1.79% return. In addition, you can check the fund’s top 5 holdings to determine its best picks for 2025.

In its first-quarter 2025 investor letter, Aristotle Capital Global Equity Strategy highlighted stocks such as Cameco Corporation (NYSE:CCJ). Cameco Corporation (NYSE:CCJ) is a leading uranium producing company. One-month return of Cameco Corporation (NYSE:CCJ) was 25.28%, and its shares gained 3.53% of their value over the last 52 weeks. On May 15, 2025, Cameco Corporation (NYSE:CCJ) stock closed at $51.59 per share with a market capitalization of $22.458 billion.

Aristotle Capital Global Equity Strategy stated the following regarding Cameco Corporation (NYSE:CCJ) in its Q1 2025 investor letter:

“Cameco Corporation (NYSE:CCJ), one of the world’s largest uranium producers, was a primary detractor during the quarter. Shares of the Canada based company declined following President Trump’s 10% tariff on Canadian energy exports to the U.S., where Cameco is a major uranium supplier. However, we believe these tariff concerns are overstated given the inelastic nature of uranium demand and the lack of substitutes. Any incremental costs would be absorbed by utilities under existing contract structures. While the company’s stock price may have followed the decline in uranium spot prices during the period, Cameco’s business is largely insulated from short-term price swings due to its extensive use of long-term contracts rather than spot-market sales.

Moreover, the company’s tier-one assets in politically stable jurisdictions, operational track record and ability to flex production—particularly at its MacArthur River and Key Lake mines—further strengthen its competitive advantage. We believe Cameco remains exceptionally well-positioned to benefit as governments around the world increasingly turn to nuclear power as a clean, secure and scalable source of energy.”

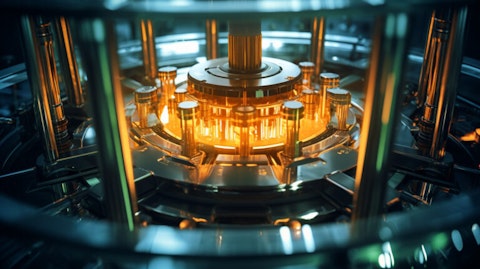

A close up of the reactor core, highlighting the complexity of the uranium power process.

Cameco Corporation (NYSE:CCJ) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 65 hedge fund portfolios held Cameco Corporation (NYSE:CCJ) at the end of the fourth quarter which was 60 in the previous quarter. While we acknowledge the potential of Cameco Corporation (NYSE:CCJ) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the undervalued AI stock set for massive gains.

In another article, we covered Cameco Corporation (NYSE:CCJ) and shared the list of small-cap energy stocks hedge funds are buying. Cameco Corporation (NYSE:CCJ) was a major contributor to Aristotle International Equity Strategy’s performance during Q4 2024. In addition, please check out our hedge fund investor letters Q1 2025 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.