Aristotle Capital Management, LLC, an investment management firm, released its “Global Equity Strategy” investor letter for the second quarter of 2025. A copy of the letter can be downloaded here. During the quarter, the global equity market surged, with the MSCI ACWI Index rising 11.53%. Aristotle Capital Global Equity Strategy returned 9.58% gross of fees (9.45% net of fees) in the second quarter, underperforming the MSCI ACWI Index’s 11.53% return and the MSCI World Index’s 11.47% return. Additionally, you can review the fund’s top 5 holdings to see its best picks for 2025.

In its second-quarter 2025 investor letter, Aristotle Capital Global Equity Strategy highlighted stocks such as Cameco Corporation (NYSE:CCJ). Cameco Corporation (NYSE:CCJ) is a leading uranium-producing company. One-month return of Cameco Corporation (NYSE:CCJ) was -0.71%, and its shares gained 91.77% of their value over the last 52 weeks. On Aug 1, 2025, Cameco Corporation (NYSE:CCJ) stock closed at $72.93 per share, with a market capitalization of $31.77 billion.

Aristotle Capital Global Equity Strategy stated the following regarding Cameco Corporation (NYSE:CCJ) in its second quarter 2025 investor letter:

“Cameco Corporation (NYSE:CCJ), one of the world’s largest uranium producers, was the biggest contributor during the quarter. The company continued to demonstrate the hallmarks of a high-quality business: a long-duration contract portfolio, disciplined capital allocation and resilience in the face of operational disruption. Despite a nearly 30% decline in uranium spot prices year-over year, Cameco reported higher average realized prices under its contracted sales—underscoring its pricing power and long term customer relationships. The company maintained stable operations despite a temporary production pause at the Inkai joint venture and wildfires in northern Saskatchewan. Meanwhile, management continued to deepen its exposure to the nuclear fuel cycle through its Westinghouse unit, which expands its reach into reactor services and fuels. With rising global interest in nuclear energy for energy security and decarbonization, Cameco’s strong balance sheet, vertically integrated platform and ability to flex production volume (thereby controlling costs) remain important catalysts in our eyes.”

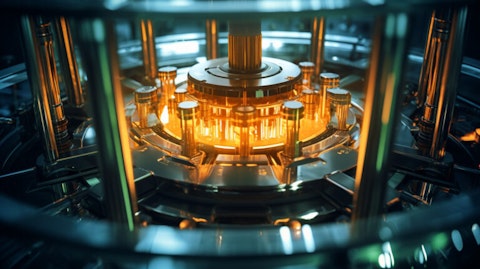

A close up of the reactor core, highlighting the complexity of the uranium power process.

Cameco Corporation (NYSE:CCJ) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 58 hedge fund portfolios held Cameco Corporation (NYSE:CCJ) at the end of the first quarter, which was 65 in the previous quarter. While we acknowledge the risk and potential of Cameco Corporation (NYSE:CCJ) as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than Cameco Corporation (NYSE:CCJ) and that has 10,000% upside potential, check out our report about this cheapest AI stock.

In another article, we covered Cameco Corporation (NYSE:CCJ) and shared the list of stocks Jim Cramer shed light on. In addition, please check out our hedge fund investor letters Q2 2025 page for more investor letters from hedge funds and other leading investors.

READ NEXT: The Best and Worst Dow Stocks for the Next 12 Months and 10 Unstoppable Stocks That Could Double Your Money.

Disclosure: None. This article is originally published at Insider Monkey.