In an ironic twist of fate, BP plc (ADR) (NYSE:BP) has put up the “for sale” sign on its $1.5 billion of wind farms to help pay for its 2010 oil spill. Is BP’s sale short-sighted, or does the energy company know something others don’t? Let’s look at wind energy, who has it, and whether wind will propel your portfolio to profits.

As part of its larger $38 billion garage sale, BP plc (ADR) is in the process of selling off 16 wind farms across nine states. With a total generating capacity of 2,600 MW, this move is far from small peanuts for a company that famously renamed itself “Beyond Petroleum” in 2000.

But with $300 billion in assets, wind is hardly the winner that BP needs to succeed. The streamlining will help it focus on high-margin oil production and exploration, its bread and butter (excepting environmental disasters). As margins tighten and the global economic recovery continues to ooze along, it makes sense for energy companies to focus on what they do best. And for some utilities, what they do best increasingly includes wind.

Windy win?

When investors talk wind, NextEra Energy (NYSE:NEE) is the elephant in the room. Its 100 wind farms generate more than 10,000 net MW of electricity, accounting for 56% of the utility’s total generation capacity.

Source: NextEra 10-K.

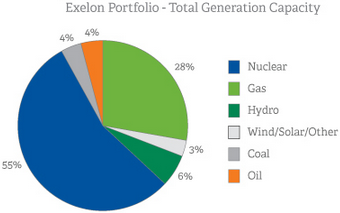

Exelon (NYSE:EXC) gets pigeonholed as a nuclear play, but its wind assets provide a significant portion of its assets. The utility operates 44 wind farms totaling nearly 1,300 MW of generation capacity, and it spent $650 million in 2012 on wind capital expenditures.

Source: Exelon investor relations website.

The newest addition to the wind gang, Atlantic Power (NYSE:AT) , recently announced that it will focus on natural gas and renewables in the years to come. The utility bought Ridgeline Energy from Veolia Environnement (NYSE:VE) last year, adding three wind farms with 150 net MW to its assets.

Source: Atlantic Power Deutsche Bank Leverage Financed Conference Presentation.

It’s also shedding less profitable assets to generate cash for acquisitions and manage its high 2.2 debt-to-equity ratio. Atlantic passed off a transmission project to Duke Energy and American Transmission for $193 million in cash and debt handoffs, and it’s planning on further specializing in the year to come.

Did BP plc (ADR) make the right choice?

Energy portfolios are a lot like ice cream. Some flavors don’t mix, and even the smallest scoop of one flavor can threaten the whole taste. BP made a calculated choice to put aside its wind assets, but one corporation’s trash is another corporation’s treasure. With the right combination, any asset class can look tasty.

The article BP Just Sold Wind: Should These Dividend Stocks Follow Suit? originally appeared on Fool.com.

Fool contributor Justin Loiseau has no position in any stocks mentioned, but he does use electricity. You can follow him on Twitter, @TMFJLo, and on Motley Fool CAPS, @TMFJLo.The Motley Fool recommends Exelon and Veolia Environment.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.