We came across a bullish thesis on Boston Scientific Corporation on R. Dennis’s Substack by OppCost. In this article, we will summarize the bulls’ thesis on BSX. Boston Scientific Corporation’s share was trading at $93.61 as of January 27th. BSX’s trailing and forward P/E were 50.06 and 26.95 respectively according to Yahoo Finance.

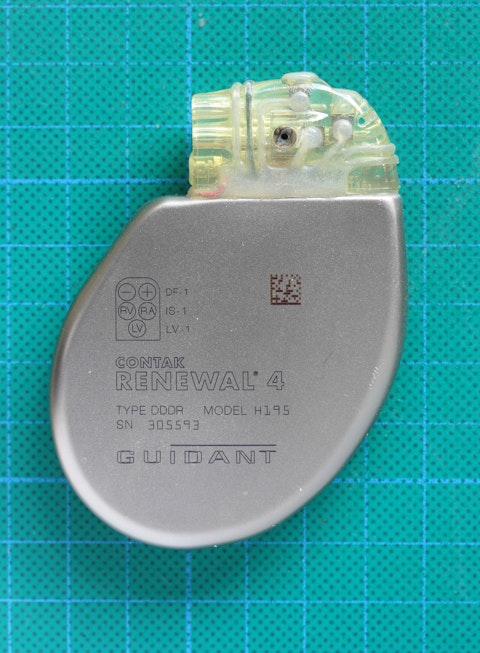

Pixabay/Public Domain

Boston Scientific Corporation develops, manufactures, and markets medical devices for use in various interventional medical specialties worldwide. BSX presents a tactical opportunity following its $14.5 billion acquisition of Penumbra (PEN), which caused a short-term 4% dip in the stock. Traders have responded by selling April $80 puts, currently out-of-the-money by roughly 11%, collecting $1.10 per share in premium, representing a total credit of $440,000 from 4,000 contracts.

This surge in volume, exceeding 8,700 contracts, signals high-conviction institutional positioning. The strategy exploits the market’s overreaction to earnings dilution of $0.06–$0.08 per share and the $11 billion financing used for the acquisition, allowing investors either to pocket the premium or acquire shares at a significant discount if the stock continues to pull back.

Elevated implied volatility around the acquisition and upcoming February earnings inflates option premiums, creating a favorable environment for put sellers, who anticipate volatility to collapse once the deal is digested. The $80 strike sits below BSX’s 52-week low of $85.98, offering a deep-value entry point for one of the leading global medical device companies.

Analysts from Needham and Morgan Stanley continue to maintain Buy ratings, with price targets of $121–$127, reflecting confidence in the company’s long-term fundamentals. BSX has reaffirmed its double-digit EPS growth targets for 2026–2028, and the Penumbra acquisition positions it to dominate high-growth neurovascular and thrombectomy markets. The primary risk remains acquisition integration, including regulatory hurdles or market perception of overpayment, but the breakeven at $78.90 provides a cushion, making this a compelling risk/reward setup for investors willing to engage in tactical put selling.

Previously, we covered a bullish thesis on Boston Scientific Corporation (BSX) by Magnus Ofstad in April 2025, highlighting its leadership in minimally invasive medical devices, innovation pipeline, and disciplined acquisitions driving strong growth. BSX’s stock price has depreciated by approximately 0.7% since our coverage due to short-term market reactions. R. Dennis shares a similar perspective but emphasizes the tactical opportunity from the $14.5 billion Penumbra acquisition and elevated option premiums.

Boston Scientific Corporation is not on our list of the 30 Most Popular Stocks Among Hedge Funds. As per our database, 102 hedge fund portfolios held BSX at the end of the third quarter which was 100 in the previous quarter. While we acknowledge the risk and potential of BSX as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than BSX and that has 10,000% upside potential, check out our report about this cheapest AI stock.

READ NEXT: 30 Stocks That Should Double in 3 Years and 11 Hidden AI Stocks to Buy NOW

Disclosure: None.