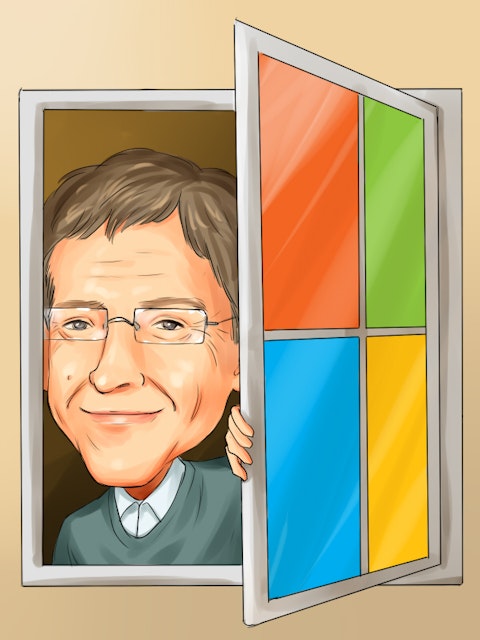

In this article we are going to take a look at an overview of Bill Gates’ net worth, his investments in some interesting startups and his 10 biggest holdings as of the third quarter of this year. If you want to skip this part and see his top 5 holdings, click Bill Gates’ Top 5 Holdings.

Bill Gates’ Net Worth

Bill Gates has been featuring in world’s richest people lists for quite some time now. As of December 19, Bill Gates’ net worth, according to Forbes’ real-time billionaires list, stands at $104.2 billion. He ranks sixth in the list. Gates enjoyed the title of the richest person in the world from 1995 until 2017, except for 2010 and 2013. In 2017, Jeff Bezos surpassed Gates to become the richest person in the world. What made Bill Gates one of the richest people on this planet was Microsoft Corp (NASDAQ:MSFT), which Gates co-founded in 1975. Microsoft Corp (NASDAQ:MSFT) now has a market cap of $1.8 trillion.

Bill Gates has given billions in charity. Earlier this year, in a tweet, Gates said that he eventually plans to give away all his wealth to Bill & Melinda Gates Foundation.

“I will move down and eventually off of the list of the world’s richest people,” the tweet said.

Bill & Melinda Gates Foundation’s annual spending is expected to rise to $9 billion per year by 2026.

Bill Gates’ Investments in Startups

Bill Gates invests in several up-and-coming startups that are working to solve some of the world’s biggest problems. As climate has been the focus area of Bill Gates over the past few years, his investments in startups are also concentrated in the energy sector. Gates invests in these promising companies via Breakthrough Energy Ventures. We will discuss five of the most prominent startups Bill Gates has invested in according to the BEV website.

– A notable investment of Bill Gates is in Turntide Technologies, a company that is working on various solutions to accelerate decarbonization. The company makes smart motors and technologies for buildings and agriculture to reduce carbon emissions.

– Bill Gates also invested in C16 Biosciences, which produces sustainable alternatives to palm oil using biotechnology. Media reports suggest C16 Biosciences is ready to launch a palm oil alternative as early as next year.

– Blue World Technologies is working on fuel cell technology that can be used in various applications to replace diesel generators and combustion engines. Bill Gates’ Breakthrough Energy Ventures took part in a 37 million euros series-B investment round for the company.

– Dandelion Energy is a geothermal startup that installs geothermal systems in homes. Last year the company received a $30 million investment from BEV.

– Another important investment of Bill Gates is LuxWall, which creates transparent, thermal insulation using vacuum glass technologies to significantly reduce building energy consumption and carbon emissions.

In addition to BEV, Bill Gates also invests in interesting startups via Bill & Melinda Gates Foundation. All these investments are listed on the trust’s website. Some notable startups which the trust is currently backing include:

– AgBiome: a biotechnology company that is working on crop protection.

– Atreca: a biotech company that makes therapeutics based on its ability to rapidly characterize the human adaptive immune response at the single cell level.

– CureVac: a Germany-based company that makes therapies and vaccines based on messenger RNA.

– Clinvet: a global veterinary contract research organization (CRO) that specializes in the conduct of clinical and pre-clinical trials to evaluate the safety, metabolism and efficacy of animal health products.

– CropIn Technology: an India-based startup that is using technology to solve problems like food insecurity, low crop yields, climate change and much more.

– Lyndra Therapeutics: a Massachusetts-based company whose drug delivery platform is designed to deliver medicine for a week or longer in an oral form.

Bill Gates’ 10 Biggest Holdings

To see Microsoft Corp (NASDAQ:MSFT) co-founder Bill Gates’ holdings, we will take a look at the 13F portfolio of Bill & Melinda Gates Foundation and pick the 10 biggest holdings of the trust as of the end of the third quarter.

10. Waste Connections Inc (NYSE:WCN)

Waste Connections Inc (NYSE:WCN) was a new arrival in Bill Gates’ portfolio in the third quarter. Bill & Melinda Gates’ foundation ended the September quarter with a $290.4 million stake in the company. Waste Connections Inc (NYSE:WCN) is a North American integrated waste services company which provides waste management services like waste collection, transfer, disposal and recycling services, primarily of solid waste. Last month, Waste Connections Inc (NYSE:WCN) declared a dividend of $0.255/share, which shows a 10.9% increase from prior dividend of $0.23.

Of the 920 hedge funds tracked by Insider Monkey as of the end of the September quarter, 33 had stakes in Waste Connections Inc (NYSE:WCN). The total value of these stakes was about $1.2 billion.

9. Coca-Cola Femsa SAB de CV (NYSE:KOF)

Headquartered in Mexico, Coca-Cola Femsa SAB de CV (NYSE:KOF) is a subsidiary of FEMSA. Coca-Cola Femsa SAB de CV (NYSE:KOF) markets and sells Coca-Cola trademark beverages. For the third quarter, Coca-Cola Femsa SAB de CV (NYSE:KOF) posted a net income of Ps.4.37 billion. Revenue in the period jumped about 18% on a year-over-year basis.

Coca-Cola Femsa SAB de CV (NYSE:KOF) is not very popular among the elite hedge funds tracked by Insider Monkey as just 9 of the 920 funds in our database reported having stakes in the company at the end of the September quarter. However, Coca-Cola Co (NYSE:KO) remains one of the most popular stocks among elite funds. At the end of the third quarter, 59 hedge funds reported having stakes in the beverage company.

8. Walmart Inc (NYSE:WMT)

Microsoft Corp (NASDAQ:MSFT)’s Bill Gates’ fund entered the last quarter of 2022 with a $392 million stake in Walmart Inc (NYSE:WMT). Last month, Bank of America analyst Robert Ohmes said that Walmart Inc (NYSE:WMT) had a stunning Black Friday shopping season. The analyst said that in the stores he visited, traffic was strong, especially in the electronics, grocery & toys sections.

The analyst noted that Walmart Inc (NYSE:WMT) stores were well-staffed and well-stocked.

In a separate report earlier in November, Ohmes had noted that Walmart Inc (NYSE:WMT) had a strong ability to survive any possible recession in the US. He had said in a report that Walmart Inc (NYSE:WMT) has less exposure to discretionary spending when compared to other players in the market like Target. He reminded investors that Walmart Inc (NYSE:WMT) had outperformed the market in the last five recessions.

7. Ecolab Inc (NYSE:ECL)

Bill Gates’ fund has been holding stakes in Ecolab Inc (NYSE:ECL) for over a decade now. At the end of the September quarter, Bill & Melinda Gates Foundation reported having a $703 million stake in Ecolab Inc (NYSE:ECL).

Ecolab Inc (NYSE:ECL) develops and offers services, technology and systems to clean and purify water. Recently, Ecolab Inc (NYSE:ECL) stock took a dive after the company gave a weak Q4 guidance and also announced Q3 results. Net earnings in the September quarter came in at $347.1 million, up from $324 million reported in the comparable quarter last year. Ecolab Inc (NYSE:ECL) expects its Q4 earnings to take $0.11 per share hit due to foreign currency headwinds and higher interest expenses.

6. Caterpillar Inc. (NYSE:CAT)

Microsoft Corp (NASDAQ:MSFT)’s co-founder Bill Gates’ fund has a $1.21 billion stake in Caterpillar Inc. (NYSE:CAT), as of the end of the third quarter. Caterpillar Inc. (NYSE:CAT) was in the news recently as the company posted strong Q3 results, thanks to the increasing demand of its earth-moving equipment and solid pricing power. Caterpillar Inc. (NYSE:CAT) rose and led the large-cap industrials group during the week ending October 28.

However, Deutsche Bank analysts downgraded the stock, citing global recession fears. Nonetheless, Caterpillar Inc. (NYSE:CAT) remains one of the strongest players in the market. The stock has gained 10% year to date despite the global market headwinds. Caterpillar Inc. (NYSE:CAT) has been increasing its dividend for the last 28 years without a break.

As of the end of the third quarter, 43 hedge funds tracked by Insider Monkey had stakes in Caterpillar. The total value of these stakes was $2.84 billion. Among the biggest stakeholders of the company are Ken Fisher’s Fisher Asset Management ($1.2 billion stake) and Ric Dillon’s Diamond Hill Capital ($311 million stake).

Click to continue reading and see Bill Gates’ Top 5 Holdings.

Suggested articles:

- 15 Biggest Endowments in the US

- Top 13 Gas Tanker Shipping Companies in the World

- 16 Large-Cap Stocks with Insider Buying

Disclosure: None. Bill Gates Net Worth, Investments and Holdings is originally published on Insider Monkey.