The results from the Federal Reserve stress tests were finally released lastThursday, and they show that the industry has come a long way in terms on balance sheet cleaning and improving capital ratios. There are some important differences among the big American banks in terms of financial strength and profitability, but the sector looks well positioned to deliver solid returns while benefitting from macroeconomic tailwinds in the middle term.

When looking at the stress test results, there are two main things to consider: the overall level of the post-test Tier 1 capital ratio, which shows how much capital each bank would have under a “stressful” scenario, and the degree of variability from pre-test to post-test levels, since it explains how vulnerable each bank’s assets would be in a hostile economic environment.

To begin with, all of the four major players: Bank of America Corp (NYSE:BAC), Citigroup Inc. (NYSE:C), PMorgan Chase & Co. (NYSE:JPM) and Wells Fargo & Co (NYSE:WFC) have pretty decent post-test Tier 1 ratios above 5%, the level considered the minimum threshold by the Federal Reserve.

Predictably, the banks with the higher resiliency in the stress test are also the ones with the higher return on equity. A financially sound company like Wells Fargo & Co (NYSE:WFC) can focus on expanding its business and increasing profitability, while weaker institutions like Bank of America and Citigroup Inc. (NYSE:C) are still in the process of cleaning their balance sheets. JPMorgan Chase & Co. (NYSE:JPM) is somewhere in the middle, not as strong as Wells Fargo & Co (NYSE:WFC) but stronger than Bank of America or Citigroup Inc. (NYSE:C).

Those factors are clearly reflected in valuations, the banks with healthier balance sheet and more profitable operations trade at higher price to book value multiples. It’s worth noting that the major banks are still trading at attractive valuation ratios in comparison to pre-crisis levels, when their price to book value ratios where in the area of 1.5/2. If balance sheets continue getting better and profitability increases, there is plenty of room for upside potential from a valuation point of view.

Macroeconomic Tailwinds

There is a big chance that banks will continue seeing improving business conditions in the middle term, not only because they are working hard for that to happen, but also due to positive economic trends. In the same way the financial crisis exposed their excessive risk taking and fundamentally weak balance sheets, a better economic environment should be very helpful in terms of depurating assets, recovering profitability and capturing growth opportunities.

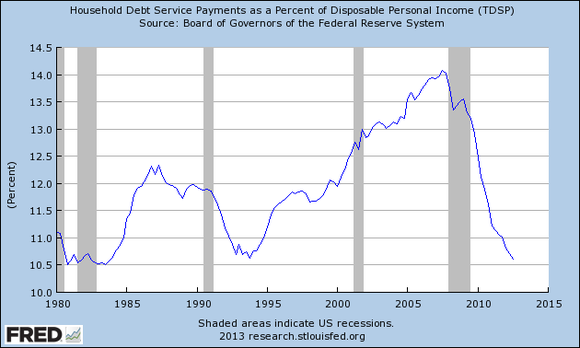

The chart from the Federal Reserve Bank of St. Louis shows a very interesting picture — household debt payments as a percentage of disposable income are reaching record lows. This means that the deleveraging process by consumers has been painful but effective, and American families are in much better financial shape than in recent years.

Another important factor to consider is that owners’ equity in real estate, meaning the value of real estate that Americans really own, seems to have finally turned the corner in 2012. This should be enormously helpful when it comes to balance sheet cleaning and improving conditions for the real estate industry.

Housing affordability is near historical highs, so buying a property seems to be both easy to do and convenient at current prices.

Speaking about prices, they seem to have bottomed too. Prices tend to move in a self-reinforcing way: once it becomes clear that the market is recovering, people start accelerating their bids in order to buy before it gets more expensive. This should especially be the case now that mortgage rates are at historically low levels thanks to the Fed´s intervention.

Bottom Line

Banks have been on a tear lately, but this move was not disconnected from their fundamentals. On the contrary, things are looking much better for the sector, both in terms of corporate balance sheets and macroeconomic trends. Valuations are still quite attractive, so the banks are well positioned to deliver strong returns while benefiting from the economic recovery over the years ahead.

The article Banking on a Recovery originally appeared on Fool.com and is written by Andrés Cardenal.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.