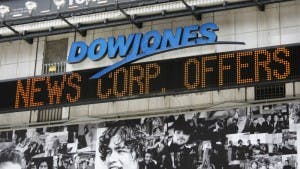

Most of the 30 stocks in the Dow Jones Industrial Average 2 Minute (INDEXDJX:.DJI) have reported their first-quarter earnings results. Overall, the positive surprises have outnumbered the negative ones, with the general assessment of the season having been favorable.

But a few stocks haven’t been able to match the expectations that investors put on them. Let’s take a closer look at five companies that missed their earnings expectations.

Any time a company’s profit quadruples from year-ago levels, you’d think it’d be cause for celebration. But for Bank of America Corp (NYSE:BAC), it wasn’t quite enough, as the bank missed estimates by $0.02 per share.

Yet on the whole, there was a lot of good news for B of A. First-lien mortgage activity was up sharply, its global investment banking division performed well, and it has managed to put some big litigation risks as well as nonperforming assets behind it. With the foresight to give up on boosting its dividend in favor of getting itself even stronger from a capital standpoint, B of A’s disappointment seems like a short-term issue.

Caterpillar served up a double-whammy for investors, missing earnings estimates by $0.07 per share and cutting its full-year 2013 guidance by a full $1 per share. The big problem for the company was its mining equipment business, which has struggled in light of slowing conditions in China and elsewhere around the world.

If anything, Caterpillar Inc. (NYSE:CAT)’s problems in mining are likely to get worse before they get better, as the big plunge in gold prices came in April after the first quarter had ended. Unless gold rebounds very quickly, expect further trouble from Caterpillar Inc. (NYSE:CAT) in the second quarter and beyond.

International Business Machines Corp. (NYSE:IBM) sent the Dow Jones Industrial Average 2 Minute (INDEXDJX:.DJI) plunging on the day after it reported earnings, missing expectations by a nickel per share despite posting a 3% increase in net income for the quarter. Sales fell 5% from the year-ago quarter, as orders from the U.S. and Chinese governments were particularly weak.

The question looking forward is whether International Business Machines Corp. (NYSE:IBM)’s claim that some large orders that didn’t close in time to get included in the first-quarter results end up coming in during the second quarter. With the company still projecting solid earnings for the year, International Business Machines Corp. (NYSE:IBM)’s disappointment seems overblown at this point, although it’s critical for the company to execute better on its strategy in the highly competitive space.