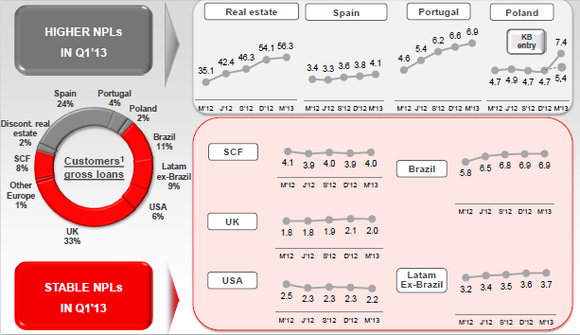

Another positive indicator for investors is that Banco Santander’s asset quality is well within acceptable parameters with a non-performing loan ratio of almost 4.8%, the majority of which is being driven by the bank´s exposure to Spain, Portugal and Poland, as the chart below illustrates.

Source: Banco Santander, January to March 2013 Financial Report.

But more importantly, two thirds of the bank´s operations, including its Latin American businesses, have stable non-performing loan ratios. This non-performing loan ratio also compares favorably with Banco Bilbao Vizcaya Argentaria SA (ADR) (NYSE:BBVA), which had a non-performing loan ratio of 5.3% at the end of the first quarter 2013, although it is significantly higher than The Bank of Nova Scotia (USA) (NYSE:BNS)´s non-performing loan ratio 0.48%.

Despite the issues being experienced in Spain and a flat gross income, Banco Santander is still delivering strong profitability in the majority of its businesses. This is evidenced by the 20% quarter-on-quarter increase in net profit in the first quarter 2013 to almost $2 billion. Part of this increase in net income can be attributed to the bank being able to reduce its loan loss provisions in the first quarter by 31% to $3.8 billion.

The bank has also been able to increase its return on equity quarter-on-quarter by a full percentage point to 6%, although this is lower than BBVA´s 16% for the same period. However, given that Banco Santander has a solid efficiency ratio of 49%, combined with decreasing loan loss provisions I expect profitability and its return on equity to improve.

The likelihood of this occurring, also becomes greater when the positive economic outlook for Latin America is taken into account. This includes key markets for Banco Santander such as Brazil, Mexico and Chile expected to experience solid economic growth through 2013 and 2014, as the chart below illustrates.

Source: Standard & Poors ‘Latin America’s Economic Growth Should Pick Up In 2013-2014 But Remain South of Prerecession Levels’.

A key driver of that growth will be Brazil because that country contributes 26% of Banco Santander´s attributable profit and is expected to see its GDP growth rate triple in 2013 and 2014.

Finally, another appealing aspect for investors, particularly income-hungry investors, is that Banco Santander has a solid dividend yield of almost 11% and despite the issues it has recently faced in Spain has retained its dividend payments despite now having a payout ratio in excess of 100% due to its falling profitability. This yield is more than double that of BBVA and Scotia Bank and is well above average for the banking sector.

Bottom Line

The sharp sell down of Banco Santander´s shares as a result of the Spanish banking crisis has created an opportunity for investors to buy into a global banking franchise at a discount. This also includes being able to geographically diversify their investment by obtaining exposure to Europe and a range of emerging Latin American markets through the one investment, while receiving a solid dividend yield.

The article Banco Santander: An Undervalued Investment Opportunity originally appeared on Fool.com is written by Matt Smith.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.