Is Axalta Coating Systems Ltd (NYSE:AXTA) a good bet right now? We like to analyze hedge fund sentiment before doing days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy league graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments (for some reason media paid a ton of attention to Ackman’s gigantic JC Penney and Valeant failures) and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

When it comes to Axalta Coating Systems Ltd (NYSE:AXTA), investors should be aware of an increase in hedge fund sentiment in recent months. To get a better sense of the stock’s popularity, at the end of this article we will also compare AXTA to other stocks including Westinghouse Air Brake Technologies Corp (NYSE:WAB), Aqua America Inc (NYSE:WTR), and Packaging Corp Of America (NYSE:PKG) to get a better sense of its popularity.

Follow Axalta Coating Systems Ltd. (NYSE:AXTA)

Follow Axalta Coating Systems Ltd. (NYSE:AXTA)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year, involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs.

Now, let’s analyze the key action surrounding Axalta Coating Systems Ltd (NYSE:AXTA).

Copyright: stockasso / 123RF Stock Photo

What does the smart money think about Axalta Coating Systems Ltd (NYSE:AXTA)?

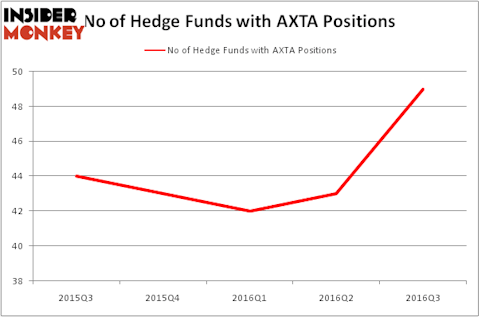

At the end of the third quarter, a total of 49 of the hedge funds tracked by Insider Monkey were long this stock, a change of 14% from one quarter earlier. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Warren Buffett’s Berkshire Hathaway has the most valuable position in Axalta Coating Systems Ltd (NYSE:AXTA), worth close to $659.4 million, accounting for 0.5% of its total 13F portfolio. On Berkshire Hathaway’s heels is Iridian Asset Management, led by David Cohen and Harold Levy, holding a $416 million position; 3.6% of its 13F portfolio is allocated to the company. Remaining members of the smart money with similar optimism contain Ric Dillon’s Diamond Hill Capital, Vinit Bodas’s Deccan Value Advisors and Lou Simpson’s SQ Advisors.

Consequently, key hedge funds have been driving this bullishness. SQ Advisors, managed by Lou Simpson, assembled the biggest position in Axalta Coating Systems Ltd (NYSE:AXTA). SQ Advisors had $149.5 million invested in the company at the end of the quarter. Benjamin A. Smith’s Laurion Capital Management also initiated a $71.9 million position during the quarter. The other funds with new positions in the stock are Eric W. Mandelblatt’s Soroban Capital Partners, Neil Chriss’s Hutchin Hill Capital, and Steve Cohen’s Point72 Asset Management.

Let’s now review hedge fund activity in other stocks similar to Axalta Coating Systems Ltd (NYSE:AXTA). These stocks are Westinghouse Air Brake Technologies Corp (NYSE:WAB), Aqua America Inc (NYSE:WTR), Packaging Corp Of America (NYSE:PKG), and Leucadia National Corp. (NYSE:LUK). This group of stocks’ market valuations are closest to AXTA’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WAB | 27 | 505221 | 0 |

| WTR | 13 | 131324 | 3 |

| PKG | 21 | 153584 | 1 |

| LUK | 29 | 800246 | 5 |

As you can see these stocks had an average of 23 hedge funds with bullish positions and the average amount invested in these stocks was $398 million. That figure was $2.88 billion in AXTA’s case. Leucadia National Corp. (NYSE:LUK) is the most popular stock in this table. On the other hand Aqua America Inc (NYSE:WTR) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks Axalta Coating Systems Ltd (NYSE:AXTA) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.