Before we spend many hours researching a company, we’d like to analyze what insiders, hedge funds and billionaire investors think of the stock first. We would like to do so because the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Axalta Coating Systems Ltd (NYSE:AXTA).

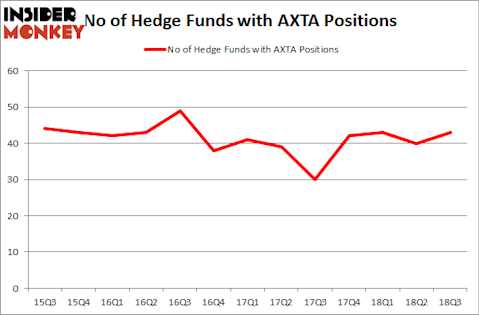

Axalta Coating Systems Ltd (NYSE:AXTA) has seen an increase in enthusiasm from smart money recently. AXTA was in 43 hedge funds’ portfolios at the end of the third quarter of 2018. There were 40 hedge funds in our database with AXTA holdings at the end of the previous quarter. Our calculations also showed that AXTA isn’t among the 30 most popular stocks among hedge funds.

To most market participants, hedge funds are viewed as slow, outdated investment vehicles of years past. While there are over 8,000 funds in operation today, Our experts look at the moguls of this club, about 700 funds. It is estimated that this group of investors command the majority of all hedge funds’ total capital, and by tailing their best investments, Insider Monkey has identified a few investment strategies that have historically surpassed the S&P 500 index. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by 6 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Warren Buffett of Berkshire Hathaway

We’re going to check out the fresh hedge fund action encompassing Axalta Coating Systems Ltd (NYSE:AXTA).

What does the smart money think about Axalta Coating Systems Ltd (NYSE:AXTA)?

Heading into the fourth quarter of 2018, a total of 43 of the hedge funds tracked by Insider Monkey were long this stock, a change of 8% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in AXTA over the last 13 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Axalta Coating Systems Ltd (NYSE:AXTA) was held by Berkshire Hathaway, which reported holding $707.5 million worth of stock at the end of September. It was followed by Diamond Hill Capital with a $310 million position. Other investors bullish on the company included Deccan Value Advisors, Soroban Capital Partners, and FPR Partners.

As aggregate interest increased, key money managers were breaking ground themselves. Zimmer Partners, managed by Stuart J. Zimmer, created the most outsized position in Axalta Coating Systems Ltd (NYSE:AXTA). Zimmer Partners had $18.7 million invested in the company at the end of the quarter. Brandon Haley’s Holocene Advisors also initiated a $13.6 million position during the quarter. The other funds with new positions in the stock are Greg Poole’s Echo Street Capital Management, David Costen Haley’s HBK Investments, and Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Axalta Coating Systems Ltd (NYSE:AXTA) but similarly valued. These stocks are NICE Ltd. (NASDAQ:NICE), TIM Participacoes SA (NYSE:TSU), Tripadvisor Inc (NASDAQ:TRIP), and Vereit Inc (NYSE:VER). This group of stocks’ market values match AXTA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NICE | 14 | 199681 | 1 |

| TSU | 16 | 265730 | 3 |

| TRIP | 26 | 1449961 | 0 |

| VER | 22 | 491655 | -3 |

| Average | 19.5 | 601757 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.5 hedge funds with bullish positions and the average amount invested in these stocks was $602 million. That figure was $2.36 billion in AXTA’s case. Tripadvisor Inc (NASDAQ:TRIP) is the most popular stock in this table. On the other hand Nice Systems Ltd (NASDAQ:NICE) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Axalta Coating Systems Ltd (NYSE:AXTA) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.