Before we spend days researching a stock idea we’d like to take a look at how hedge funds and billionaire investors recently traded that stock. S&P 500 Index returned about 7.6% during the last 12 months ending November 21, 2016. Most investors don’t notice that less than 49% of the stocks in the index outperformed the index. This means you (or a monkey throwing a dart) have less than an even chance of beating the market by randomly picking a stock. On the other hand, the top 30 mid-cap stocks among the best performing hedge funds had an average return of 18% during the same period. Hedge funds had bad stock picks like everyone else. We are sure you have read about their worst picks, like Valeant, in the media over the past year. So, taking cues from hedge funds isn’t a foolproof strategy, but it seems to work on average. In this article, we will take a look at what hedge funds think about athenahealth, Inc (NASDAQ:ATHN) .

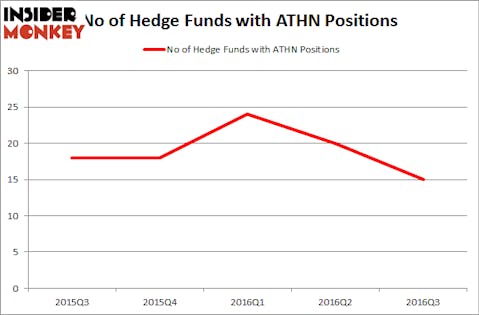

athenahealth, Inc (NASDAQ:ATHN) shareholders have witnessed a decrease in hedge fund interest recently. 15 hedge funds that we track were long the stock on September 30. There were 20 hedge funds in our database with ATHN holdings at the end of the previous quarter. At the end of this article we will also compare ATHN to other stocks including Pinnacle Foods Inc (NYSE:PF), Carter’s, Inc. (NYSE:CRI), and Six Flags Entertainment Corp (NYSE:SIX) to get a better sense of its popularity.

Follow Athenahealth Inc (NYSE:ATHN)

Follow Athenahealth Inc (NYSE:ATHN)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Manczurov/Shutterstock.com

Hedge fund activity in athenahealth, Inc (NASDAQ:ATHN)

At the end of the third quarter, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a 25% slide from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards ATHN over the last 5 quarters, which shows a steep drop in ownership over the past 2 quarters. With hedgies’ capital changing hands, there exists a select group of key hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Israel Englander’s Millennium Management has the biggest position in athenahealth, Inc (NASDAQ:ATHN), worth close to $76.1 million. The second most bullish fund manager is Dmitry Balyasny of Balyasny Asset Management, with a $17.1 million position. Remaining peers with similar optimism include Steve Cohen’s Point72 Asset Management, Efrem Kamen’s Pura Vida Investments, and Brian Ashford-Russell and Tim Woolley’s Polar Capital. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

We already know that not all hedge funds are bullish on the stock and some hedge funds actually cashed in their positions entirely. Interestingly, Principal Global Investors’ Columbus Circle Investors cashed in the largest position of all the hedgies followed by Insider Monkey, comprising an estimated $14.4 million in stock, and David E. Shaw’s D E Shaw was right behind this move, as the fund cut about $6.7 million worth of shares.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as athenahealth, Inc (NASDAQ:ATHN) but similarly valued. We will take a look at Pinnacle Foods Inc (NYSE:PF), Carter’s, Inc. (NYSE:CRI), Six Flags Entertainment Corp (NYSE:SIX), and Servicemaster Global Holdings Inc (NYSE:SERV). All of these stocks’ market caps match ATHN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PF | 41 | 1449617 | 8 |

| CRI | 35 | 1037585 | -3 |

| SIX | 28 | 1041188 | -4 |

| SERV | 36 | 1305900 | 4 |

As you can see these stocks had an average of 35 hedge funds with bullish positions and the average amount invested in these stocks was $1.21 billion. That figure was $157 million in ATHN’s case. Pinnacle Foods Inc (NYSE:PF) is the most popular stock in this table. On the other hand Six Flags Entertainment Corp (NYSE:SIX) is the least popular one with only 28 bullish hedge fund positions. Compared to these stocks athenahealth, Inc (NASDAQ:ATHN) is even less popular than SIX. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock, and why it’s been bleeding smart money investors over the last 2 quarters.

Disclosure: None