AstraZeneca plc (NYSE:AZN) could easily acquire Gilead Sciences, Inc. (NASDAQ:GILD)

Headlines:

- Market Dynamics May Inspire AZN To Re-Engage.

- A $200B+ Healthcare Juggernaut May Result.

Q2 2020 hedge fund letters, conferences and more

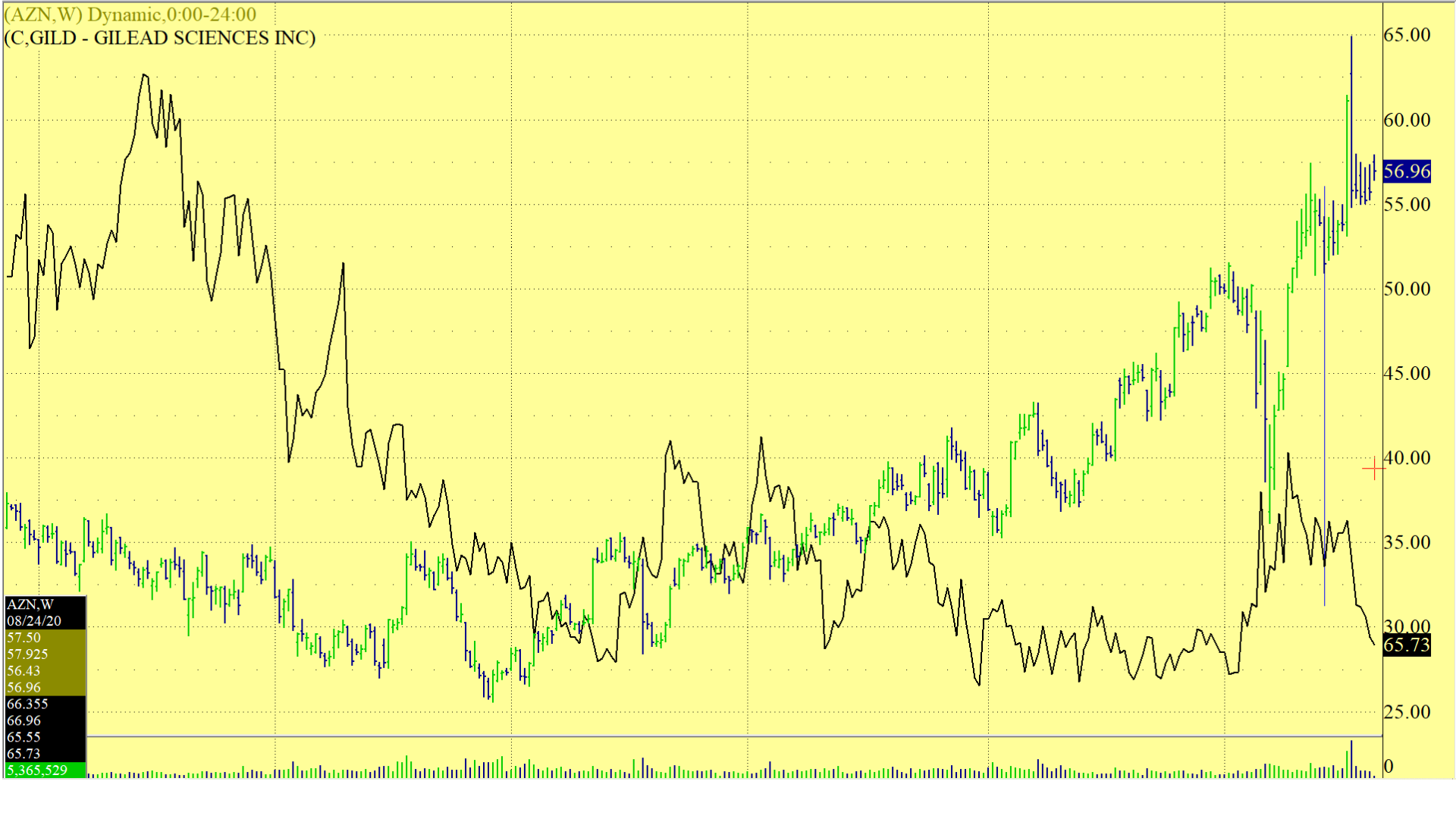

Since June 8, 2020…When Speculation Bubbled About A Possible AstraZeneca-Gilead Sciences Combination [see vertical line in above chart]…The Following “Deal” Metrics Have Adjusted…Quite Dramatically In AZN’s Favor…

- British Pound [AZN] = +3.13% vs. US Dollar [GILD]

- AZN Share Price = +8.33%

- GILD Share Price = -14.32%

…Lifting AstraZeneca’s Enterprise Value To Almost 1.8x Gilead Sciences’…The Market’s Invisible Hand May Be Tempting AZN To Outright Acquire GILD…Rather Than The Prior Merger Chatter.

Worthwhile To Note…Also…That While Gilead Apparently Rebuffed AstraZeneca’s Overtures Earlier This Year …Current CEO’s…Pascal Soriot At AstraZeneca + Daniel O’Day At Gilead…Simultaneously…Worked Together At Swiss Drug Giant Roche.

So…Likely…The Discussions Were More Than Plain Cordial + Superficial.

And Make No Mistake…Being Acquainted With Each Other = A Big Help In Corporate Courting Matters.

Further…A Deal To Sell Gilead Could Bail Out O’Day’s Brief And…Thus Far…Disappointing Legacy At Gilead…Initiated March 2019…Partially…With The Hope Of Inspiring New Product Revenue Streams…And Hence…The Share Price.

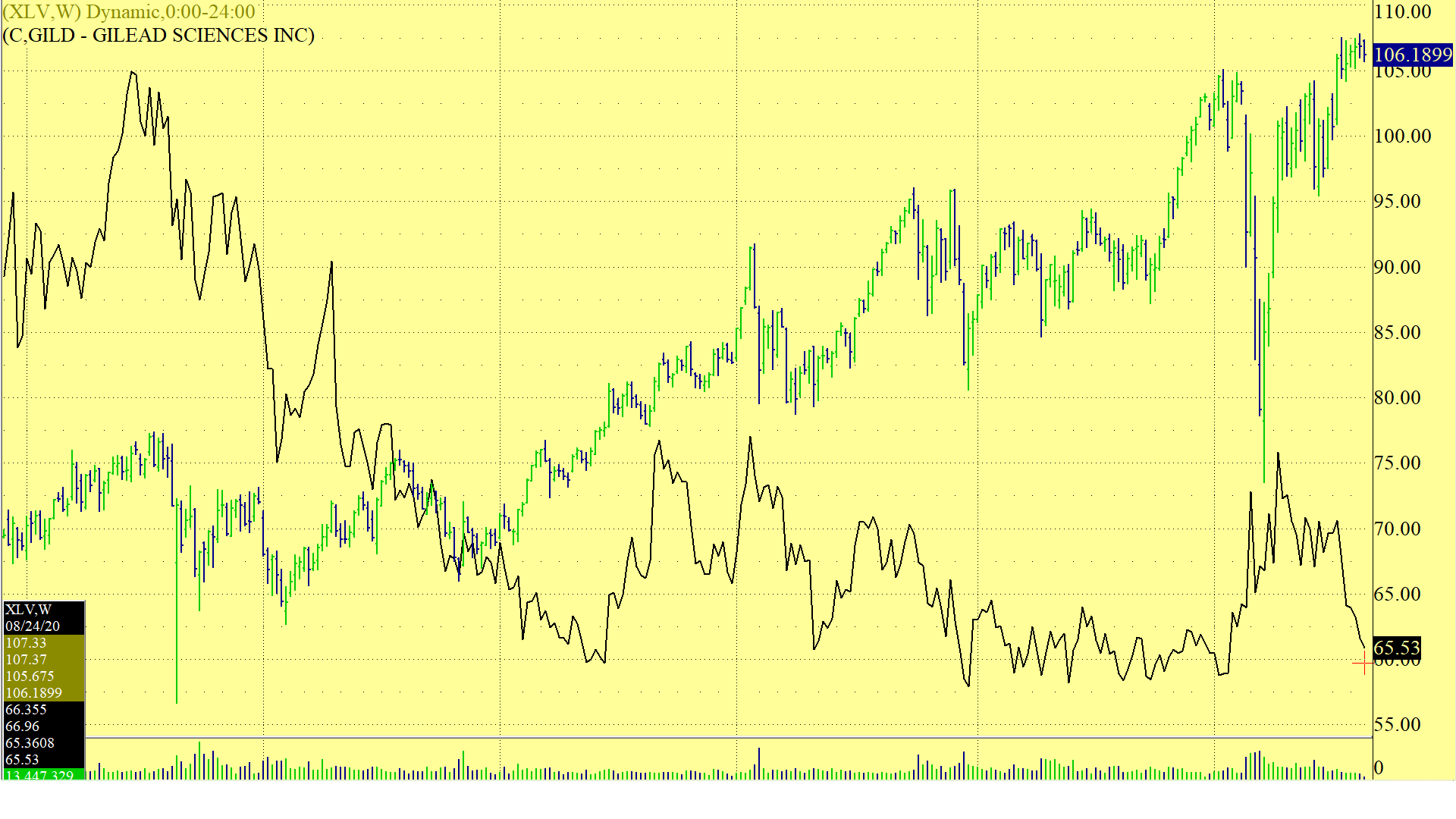

Thus Far…Neither Have Occurred…Despite Covid Driven Hopes For Several Months…Earlier This Year…As Shares Continue To Dismally Lag Its Peers …While Wall Street Seems To Be Tremendously Unimpressed With Both O’Day’s Execution And His Strategic Vision.

Plus GILD’s Relative Share Price…Vis-A-Vis the XLV Healthcare Index [see below] Further Validates…Even Pre-Dating O’Day’s Arrival…Despite Being A Strong Cash Flow Generator With A Bulletproof Balance Sheet And A 4.1% Dividend Yield.

So…IF…AstraZeneca Is Genuinely Interested In Acquiring Gilead Sciences…Now May Not Be Such A Bad Time…Certainly MUCH Better Than Early June.

And GILD Shareholders…Frustrated With The Stock’s Dramatic Under-Performance For Almost 4 Full Years [Pre + Post O’Day]…Would Likely Encourage + Rubberstamp Any Reasonable Offer From AZN.

For It’s Part…AZN Folds Several Solid Franchise Hepatitis + HIV Drugs Into Its Existing Portfolio…Structured As A Capital Accretive Deal Without Much Financial Risk Given GILD’S Investment Grade Credit Ratings.

In A Suppressed Interest Rate Environment Begging For Investment Grade Debentures…The Financing Would Essentially Be A “Slam Dunk”…Though A Sizeable Equity Component From AZN = Logical.

Plus…The Ego “Kicker” For All Interested Parties = The “New-Co” Would Automatically Gain Membership To An Exclusive U.S. Club Comprised Of Just Two Other $200B EV Members…[Merck + Pfizer]…And Prove To Be A Formidable Global Pharmaceutical Giant…An Appropriate Creation From Two Former Roche Executives.

By Jacob Wolinsky