Like many other real estate investment trusts (REITs), mortgage REITs have sold off of late. That drop, however, doesn’t make them buys. Investors should still avoid ARMOUR Residential REIT, Inc. (NYSE:ARR), American Capital Mortgage Investment Crp (NASDAQ:MTGE), Chimera Investment Corporation (NYSE:CIM), and Annaly Capital Management, Inc. (NYSE:NLY).

The carry trade

Mortgage REITs use equity and, more importantly, debt to buy mortgages. With interest rates at historically low levels, these REITs have been able to use cheap debt to build massive portfolios. According to Fed Governor Jeremy Stein, these companies were able to effectively double the size of their portfolios in around two years. That’s a huge increase.

Such growth may sound like a great deal, but the risk is that mortgage REITs are essentially creating a carry trade. They make money from the difference between the rate at which they borrow and the rates at which they earn. If either, or both, of those rates go in the wrong direction, the business model falls apart—fast.

That can lead to dividend cuts and portfolio values falling. For evidence of the risks, The Financial Times recently noted that, “[e]very one of the most popular class of US mutual funds investing in bonds lost money in May, highlighting the risks for investors as interest rates rise.” Mortgage REITs are little more than a leveraged portfolio of mortgage-backed bonds.

Steady dividends, falling value

American Capital Mortgage Investment Crp (NASDAQ:MTGE) has done the best job of supporting its dividend, holding it steady at $0.90 a quarter for the past five quarters. However, interest rate fears have led to an over 20% drop in the share price over the last three months.

The bulk of the fall, however, has occurred in just the last month or so. The shares recently offered an impressive 17% dividend yield. Clearly, the market is predicting a dividend cut. That’s not surprising since the company’s book value per share fell from $25.74 at the end of 2012 to $24.25 at the end of the first quarter. That’s a $1.49 drop, or nearly 6%, in a single quarter.

Even if the company can manage to continue paying its $3.60 annual dividend, the share price drop over the last three months from around $26 to about $21 has more than wiped out the benefits of the dividend. And if the dividend gets cut, the share price could head quickly lower, too.

Dividend cuts

ARMOUR Residential REIT, Inc. (NYSE:ARR) paid $1.52 per share in dividends in 2010, $1.41 in 2011, and $1.20 in 2012. The current dividend is $0.07 per share paid monthly. That equates to just an $0.84 annual dividend. To be fair, the company paid $0.08 per share for the first three months of the year, so the full year tally, assuming the dividend isn’t cut again, would be $0.87 per share, a nearly 30% drop from 2012 and over 40% from 2010.

The shares, meanwhile, have fallen over 40% since the start of 2010, interestingly the same amount as the dividend. Granted, the last year has accounted for a big chunk of the price decline, but the company’s yield of around 17% looks more like a siren’s call than a good investment.

Another cutter

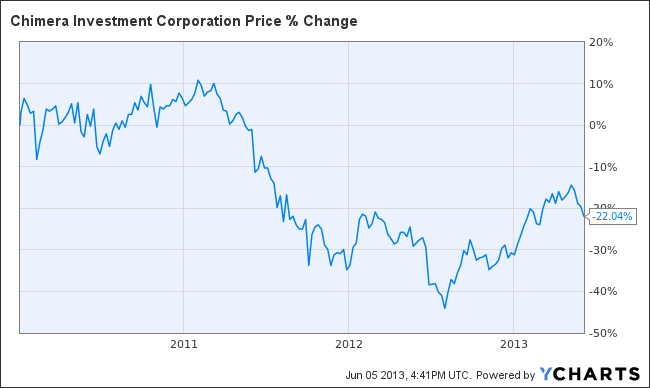

Chimera Investment’s quarterly dividend peaked at $0.18 per share per quarter in October 2010, and has pretty much fallen since. It now stands at half that rate. The stock has fallen over 20% since January of 2010. Moreover, the company is late with its regulatory filings for the first quarter. Amazingly, the stock is up over 15% so far this year. Despite a “more reasonable” yield of around 12% and a stable share price, there is still too much risk here.

Yet another dividend cut

Annaly Capital Management’s quarterly dividend peaked at the start of 2010 at $0.75 per share and currently stands at $0.45. That’s a 40% cut. The shares, meanwhile, have fallen over 20% since the start of 2010. Although the shares yield an impressive 13% or so, just like the other mortgage REITs, the risks are material. It isn’t worth jumping aboard just to see your dividend stream shrink, particularly with the risk of continued share weakness.

Too good to be true

Mortgage REIT yields are simply too good to be true. While investors have gotten notable dividend payments from these securities, that income stream has generally been declining. Moreover, share price depreciation has also been a big issue. Interest rates are at historic lows and more likely to move higher over the long-term than lower. Even after the recent REIT sell off, these stocks aren’t worth the risk for long-term investors.

Reuben Brewer has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned.

The article Mortgage REITs Are Still a Sell originally appeared on Fool.com.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.