There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Carl Icahn and George Soros think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other successful funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze Synergy Resources Corp (NYSEMKT:SYRG).

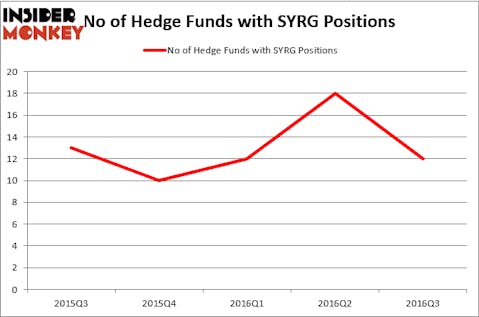

Synergy Resources Corp (NYSEMKT:SYRG) investors should pay attention to a decrease in enthusiasm from smart money of late. 12 hedge funds that we track were long the stock on September 30. There were 18 hedge funds in our database with SYRG positions at the end of the June quarter. At the end of this article we will also compare SYRG to other stocks including Meritage Homes Corp (NYSE:MTH), Clovis Oncology Inc (NASDAQ:CLVS), and Axovant Sciences Ltd (NYSE:AXON) to get a better sense of its popularity.

Follow Src Energy Inc. (NYSE:SRCI)

Follow Src Energy Inc. (NYSE:SRCI)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

huyangshu/Shutterstock.com

Hedge fund activity in Synergy Resources Corp (NYSEAMEX:SYRG)

At Q3’s end, a total of 12 of the hedge funds tracked by Insider Monkey were long this stock, a 33% decline from the previous quarter. On the other hand, there were a total of 10 hedge funds with a bullish position in SYRG at the beginning of this year, so ownership is still up for the year. With hedgies’ sentiment swirling, there exists a few notable hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Stuart J. Zimmer’s Zimmer Partners has the most valuable position in Synergy Resources Corp (NYSEMKT:SYRG), worth close to $93.4 million, amounting to 2.5% of its total 13F portfolio. On Zimmer Partners’ heels is Fine Capital Partners, led by Debra Fine, holding a $65 million position; the fund has 6.7% of its 13F portfolio invested in the stock. Remaining professional money managers that hold long positions include Millennium Management, one of the 10 largest hedge funds in the world, Anand Parekh’s Alyeska Investment Group, and David Zusman’s Talara Capital Management. We should note that two of these hedge funds (Zimmer Partners and Talara Capital Management) are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.