Based in Luxembourg, ArcelorMittal (ADR) (NYSE:MT) is a multinational steel manufacturing corporation. With an annual crude steel production of 97.2 million tonnes, ArcelorMittal is the world’s largest steel producer. ArcelorMittal (ADR) (NYSE:MT) makes long products including bars and rods, flat products including sheets and plates, and stainless steel products. The company has five segments: Flat Carbon Europe, Flat Carbon Americas, Long Carbon Americas & Europe, Asia, Africa and Commonwealth of Independent States (AACIS), and Distribution Solutions.

In the first week of February, ArcelorMittal (ADR) (NYSE:MT) announced its earnings for the fourth quarter of 2012. EBITDA fell to $1.32 billion from $1.71 billion in the same quarter last year. For the year, the company reported a net loss of $3.73 billion amid a $4.3 billion write-down in Europe. Low European demand and a sluggish Chinese market were the core reasons behind this.

Sales were down 10% to $84.2 billion. The company produced 88.2 million tons of steel in 2012. The company’s premier steel product, European hot-rolled coil, was down to its lowest sales in more than two years. By the end of fourth quarter, AreclorMittals’ net debt decreased $1.4 billion to $21.8 billion.

What’s in store for 2013?

The company expects its output to increase by 2%-3% in 2013. Global steel consumption is expected to increase by 3% in 2013 mainly thanks to growth in Brazil and China. In Brazil, consumption is expected to grow to 5% in 2013 as compared to 1% in 2012. Unfortunately, the European steel market is expected to decline by a further 1 % next year. As far as earnings are concerned, analysts expect ArcelorMittal (ADR) (NYSE:MT) to report an EBITDA of around $8 billion in 2013.

Valuation

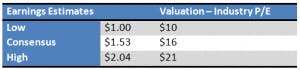

ArcelorMittal (ADR) (NYSE:MT) is trading at a forward P/E (1yr) of 9.97x, making it a slightly cheaper buy in the steel industry. It has a dividend yield of 4.10% and has a strong PEG of 0.71. Using an industry forward P/E of 10.4x, I would value ArcelorMittal:

Using consensus estimates, I value ArcelorMittal at $16, showing an upside potential of a meager 5%. Adding its high dividend yield of 4.10% to this gives us a total return of more than 8%.

Steel industry’s Major Players

The largest steel producer in the United States, Nucor Corporation (NYSE:NUE), is trading at a forward P/E (1yr) of 12.05x and has a dividend yield of 3.10%. A mean recommendation of 2.2 on the sell side clearly shows that it’s one of the top buys in the steel industry. Using earnings multiple, I’d value Nucor at $55; hence, it’s undervalued by almost 20%. This makes Nucor one of the most attractive buys in the steel industry. You can have a further look at my detailed take on Nucor Corporation here.

On the other hand, United States Steel Corporation (NYSE:X) is trading at a forward P/E (1yr) of 9.61x and has a dividend yield of 0.90%. A mean recommendation of 2.9 on the sell side testifies the fact that the company isn’t an attractive buy at this stage. Using earnings multiples, I value U.S. Steel at $23, which shows that it’s trading at its fair value. My comprehensive analysis on U.S. Steel Corporation can be found here.

Conclusion

A sluggish Chinese economy and lower than expected consumption in the European market were the chief culprits behind a lackluster year for the steel giant. 2013 looks to be a relatively better year, but not by a great margin. As Europe still faces more steel production than demand, prices are expected to remain on the low end. China looks to be in a better shape as demand is expected to improve slightly this year. As far as the U.S. is concerned, the recent boom in the automotive sector will have a positive effect on the steel industry. However, the recent European defense cuts haven’t helped the cause. Moreover, with the looming risk of U.S. defense cuts, things still look bleak for the steel industry. ArcelorMittal’s high beta of 2.43 reflects its dependence on macroeconomic forces, showing that it’s one of the most cyclical stocks in the steel industry. The bottom line is that the steel industry is expected to perform better than it did in 2012, but it still needs more time to recover, and so does ArcelorMittal. In short, I still remain neutral on this steel giant.

The article What’s In Store For This Steel Giant? originally appeared on Fool.com and is written by Waqar Saif.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.