Some believe that high end smartphones will lose relevance as lower end phones that are priced in the $100 range remove the need for more advanced smartphones.

Problems with low-end smart phones

The problem I have with that point of view is that technology is not at the point where it fully utilizes the potential of computing on the go. Mobile devices, while powerful, aren’t anywhere nearly as powerful as desktop or laptop computing counterparts, which implies that a market for high-end phones will always exist. Smart phone technology is more about energy efficiency than power. Advances in battery technology may make it feasible in the future for mobile phones to be more power efficient and more powerful, like their desktop counterparts.

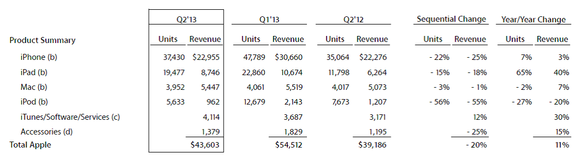

Source: Apple Inc. (NASDAQ:AAPL)

Apple defectors will lose valuable programs and data

It seems the loyalty consumers have to a platform has only increased. The iTunes/Software/Services segment saw 30% year-over-year revenue growth, even as sales of iPhone units only increased by 7% year-over-year. This may imply that in Apple Inc. (NASDAQ:AAPL)’s next upgrade cycle, iPhone demand may outpace expectations. The reasoning is that consumers in the Apple ecosystem have already invested heavily into its software applications and services, so it is logical for pre-existing users to buy into the next iteration of Apple’s iPhone. It also helps that Apple’s software services are interchangeably accessible between all of Apple’s products, including the Mac.

Don’t buy into the negativity

I wouldn’t buy into the criticism that anyone can do what Apple Inc. (NASDAQ:AAPL) did. I also believe that Apple customer loyalty will be on the rise as people have invested significantly in Apple-based software that will not transfer over to Google Inc (NASDAQ:GOOG)’s Android or Microsoft Corporation (NASDAQ:MSFT)’s Windows 8.

Since that is the case, it is unlikely that Google’s Android will be able to capture market share wins over the long haul. Apple Inc. (NASDAQ: AAPL) sees growth in not only its mobility division but also in its Mac division–Apple’s Mac segment grew by 7% year-over-year. The reason for this growth in Mac demand is driven by the iCloud, which enables users to save all their apps, document data, etc. onto a single account. This makes it easier for users to upgrade all of their devices, whether it is a desktop, laptop, tablet, and even smartphone.

Apple’s ecosystem is superior to Google’s for one simple reason: the integration of the devices between mobility and desktop/laptop computing. Google’s Android doesn’t have interchangeable compatibility with Microsoft Windows devices, which means that Android is a partial ecosystem because it doesn’t effectively integrate desktop and laptop users.

This is important to both Google and Microsoft because according to Gartner statistics, Apple’s market share has grown to 11.6% in the first quarter of 2013, versus 9.8% from the year ago period. That being the case, Apple Inc. (NASDAQ:AAPL)’s computer system only represents 12.5% of the company’s total revenues. So while the contributions are limited, it is leading to the conclusion that fully vertical ecosystems, when executed properly, win the hearts of consumers over time.

According to PiperJaffray’s, the next phone purchase will most likely be Apple’s iOS for 59% of teenagers.

Source: PiperJaffray

According to ComScore, Apple Inc. (NASDAQ:AAPL) was able to gain 2.7% market share within the United States in the first quarter of 2013. Currently, Apple has 39% of the United States smart phone market. This may mean that Apple could eventually reach 59% market share within the United States based on the survey statistics for teenagers by PiperJaffray’s.

Google’s Android strategy, while effective initially, may not have been as effective as Apple’s smartphone strategy over time. This can be reflected by the 1.4% decline in market share for Android-based smart phones over the first quarter of 2013.

Microsoft is determined to provide a unifying product platform that is similar to that of Apple Inc. (NASDAQ:AAPL). This means Microsoft will be shoving Google out the door. Microsoft has the desktop market in the palm of its hand. The usefulness of desktop and laptop computing cannot be replaced through mobile phones. Content generation has to be done on a desktop or laptop computer, meaning that Microsoft is the most likely contender to ruining if not dismantling Google’s Android ecosystem. After all, it is Microsoft that has the resources to do so, and the Windows 8 platform.

Conclusion

Google has done a marvelous job of unifying the handset manufacturers. I get the feeling that Microsoft will aggressively expand its market presence in mobility. This may mean throwing Google and all of its mobile manufacturers under the bus. The question is a matter of whether or not Microsoft will adopt a more vertical business strategy.

Some point out that Microsoft’s paid operating system versus Google’s free platform doesn’t even merit comparison based on price alone. But when you factor in the wholesomeness of having a unified computing experience across all electronic devices, Google could end up losing market share to Microsoft. As a result, Google will be forced to create an operating system for the desktop and laptop space. This will make Google the third alternative in desktop and laptop computing.

Alexander Cho has no position in any stocks mentioned. The Motley Fool recommends Apple and Google. The Motley Fool owns shares of Apple, Google, and Microsoft.

The article Apple’s Future originally appeared on Fool.com.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.