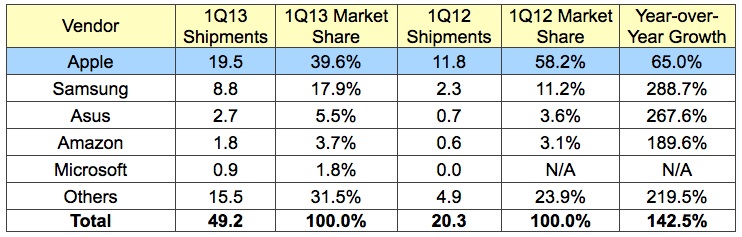

There are a few major companies that have seen shipment numbers increase, but some have seen market share slip into the hands of their competitors. The graph below shows how much Apple Inc. (NASDAQ:AAPL)’s market share has fallen, despite shipping 800,000 more than what was expected.

Source: IDC

Apple Inc. (NASDAQ:AAPL) still holds more than double the market share of its closest competitor, Samsung, but it lost nearly 20% from one year ago. Notice Amazon.com, Inc. (NASDAQ:AMZN) tripled its sales and increased market share by 0.6% as well. Tablets could very well be the saving grace for some companies that are traditionally known as PC companies. For example, Microsoft Corporation (NASDAQ:MSFT) may have only sold 900,000 units, but this led to 18% more revenue than the same quarter one year ago.

The mobile focus

More than anything, the graph above shows why companies should be focused on the mobile market. Overall, shipments more than doubled in just one year. NPD also predicts that, by 2017, six tablets will be sold for every one PC. In 2012, iPads accounted for approximately 21% of Apple Inc. (NASDAQ:AAPL)’s total revenue. In 2017, it is projected that nearly 28% of the company’s revenue will come from these same devices.

Microsoft Corporation (NASDAQ:MSFT) seems to be headed in the right direction. If it can continue to increase its tablet market share, there is no reason why it won’t successfully replace what is expected to be a bad few years for the PC market. However, there is a glimmer of hope for companies looking to sell touch-enabled notebooks. NPD senior analyst, Richard Shim, said:

The mobile PC industry is undergoing significant change. The rapid rise and establishment of white box tablet PCs is putting pressure on traditional notebook PCs, resulting in cannibalization by tablet PCs. Thus far, Windows 8 has had a limited impact on driving touch adoption in notebook PCs, due to a lack of applications needing touch and the high cost of touch on notebook PCs.

Good or bad?

This can be viewed as good news or bad news. Take your pick – mine is that there is obviously room for improvement, and that is good. I always try to look at the positive side of things, and there is a lot of potential here for Microsoft Corporation (NASDAQ:MSFT). Touch-enabled notebooks are expected to increase 48% in 2014. In fact, it is expected to increase for the next few years, including more than 100 million sold devices by 2015. All of this, from virtually nothing in 2012.

Now, from my perspective, it would be hard for Amazon.com, Inc. (NASDAQ:AMZN) not to succeed when looking at this information. First of all, the company’s Kindle sales should increase dramatically. Aside from selling its own devices, it should benefit from the increased number of sales from Apple and Microsoft Corporation (NASDAQ:MSFT).

Amazon and Apple Inc. (NASDAQ:AAPL) have already seen revenues increase for ten consecutive years, while Microsoft Corporation (NASDAQ:MSFT) saw one decrease in 2009. With the rising tide of tablet sales, these impressive trends should continue.

Despite Amazon.com, Inc. (NASDAQ:AMZN)‘s FCF yields being in the negatives, the company’s capital expenditures have soared in the past few years. Investors should see value in this, as the company is still fairly new, and is certainly growing as quickly as it can. For Apple Inc. (NASDAQ:AAPL) and Microsoft Corporation (NASDAQ:MSFT), both of their FCF yields are very appealing for value investors. Apple Inc. (NASDAQ:AAPL)‘s FCF yield is 10.2%, while Microsoft’s is a solid 9.7%.

The foolish bottom line

All three of these companies should benefit greatly from this explosion of tablet devices. We have known that mobile will play a huge role moving forward, and NPD has done nothing but re-affirm these thoughts. Hopefully, these companies will grasp the opportunity at hand and make the most of it.

The article Tablets Over PCs: The Buying Opportunity originally appeared on Fool.com and is written by Tyler Wofford.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.