Andvari Associates, an investment management firm, published its fourth-quarter 2021 investor letter – a copy of which can be seen here. A quarterly net return of 11% was delivered by the fund for the year 2021, below its S&P 500 and Russell 2000 benchmarks that delivered a 28.7% and 14.8% return respectively for the same period. Spare some time to check the fund’s top 5 holdings to have a clue about their top bets for 2022.

Andvari Associates, in its Q4 2021 investor letter, mentioned Novanta Inc. (NASDAQ: NOVT) and discussed its stance on the firm. Novanta Inc. is a Bedford, Massachusetts-based manufacturing company with a $5.5 billion market capitalization. NOVT delivered a -11.93% return since the beginning of the year, while its 12-month returns are up by 20.84%. The stock closed at $155.29 per share on January 14, 2022.

Here is what Andvari Associates has to say about Novanta Inc. in its Q4 2021 investor letter:

“Andvari started a position in Novanta within the last two years. We’ve allowed it to fly under the radar. However, with Novanta being a top performing position in Andvari’s portfolio during 2021, it’s appropriate to introduce you to the company.

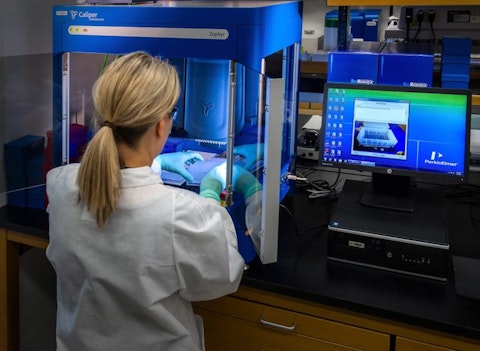

Novanta is a company in a similar vein as Danaher and Roper. The company acquires niche businesses that make highly engineered solutions based on proprietary technology. These solutions are typically embedded in customer products for about ten years and provide enormous value for their cost. For example, Novanta’s subsidiaries provide the sub-systems that enable the precision motion required by robotic surgery or the proper functioning of high throughput DNA sequencers.

Novanta has also developed its own program of continuous improvement and growth: the Novanta Growth System (NGS). There is still ample room to apply NGS across current subsidiaries as well as all future acquisitions.

From 2012 to the last trailing twelve months (as of 9/30/21), Novanta has grown adjusted revenues at a 13% annualized rate. Adjusted EBITDA has grown at a 14.9% annualized rate. The company has achieved these growth rates by divesting and acquiring several businesses since 2012. Importantly, the company has acquired businesses using its cash flows and debt, not by issuing equity and diluting current shareholders.

As of the last twelve months, Novanta earned about $650 million in revenues with EBITDA margins in the high teens. With a focus on acquiring niche businesses and applying NGS, Novanta is still in the early stages of compounding value at high rates.”

Our calculations show that Novanta Inc. (NASDAQ: NOVT) failed to obtain a mark on our list of the 30 Most Popular Stocks Among Hedge Funds. NOVT was in 15 hedge fund portfolios at the end of the third quarter of 2021, compared to 16 funds in the previous quarter. Novanta Inc. (NASDAQ: NOVT) delivered a -3.85% return in the past 3 months.

You can find other letters from hedge funds and prominent investors on our hedge fund investor letters 2021 Q4 page.

Disclosure: None. This article is originally published at Insider Monkey.