Analog Devices, Inc. (NASDAQ:ADI) is one of the 10 Stocks to Watch in July as AI Enthusiasm Returns.

Jordan Klein, Tech Media & Telecom Analyst at Mizuho, in a recent program on CNBC talked about revenue contribution from the defense sector for Analog Devices (ADI).

“No particular semi company gets, I would say, an outsized portion of the revenue from the defense sector, just because that sector traditionally hasn’t grown that fast. But there’s a few companies—one in the analog space is Analog Devices, Inc. (NASDAQ:ADI)—that gets some decent revenue from defense.”

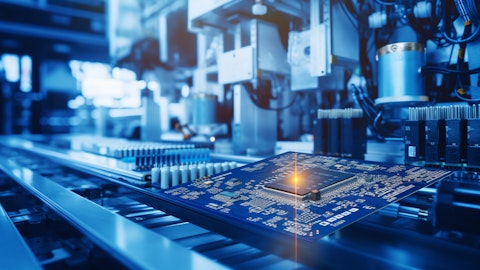

A technician working on power management in a semiconductor factory.

Aristotle Atlantic Core Equity Strategy stated the following regarding Analog Devices, Inc. (NASDAQ:ADI) in its Q1 2025 investor letter:

“Analog Devices, Inc. (NASDAQ:ADI) is a global semiconductor leader dedicated to solving customers’ most complex engineering challenges. The company delivers innovations that connect technology to human breakthroughs and play a critical role at the intersection of the physical and digital worlds by providing the building blocks to sense, measure, interpret, connect and power. Analog designs, manufactures, tests and markets a broad portfolio of solutions. These solutions include integrated circuits, software and subsystems that leverage high-performance analog, mixed-signal and digital signal processing technologies. Its comprehensive product portfolio, deep domain expertise and advanced manufacturing span high-performance precision and high-speed mixed-signal, power management and processing technologies, including data converters, amplifiers, power management, radio frequency, integrated circuits, edge processors and other sensors. The company’s customers include original equipment manufacturers and customers that build electronic subsystems for integration into larger systems.

We see the company’s analog products providing exposure to high-growth trends, including automotive electrification and driver assistance systems, factory intelligence and automation, the Intelligent Edge, Internet of Things device proliferation and sustainable energy. We expect the company to return excess free cash flow, benefiting shareholders.”

While we acknowledge the risk and potential of ADI as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than ADI and that has 10,000% upside potential, check out our report about this cheapest AI stock.

READ NEXT: 30 Stocks That Should Double in 3 Years and 11 Hidden AI Stocks to Buy Right Now.

Disclosure: None. This article is originally published at Insider Monkey.