We recently published 10 Stock News You Can’t Miss As Investors Watch AI Trade Momentum. Micron Technology Inc (NASDAQ:MU) is one of the stock news you can’t miss.

OptionsPlay’s Tony Zhang recently talked about Micron during a recent interview with Schwab Network. The analyst believes Micron’s valuation is attractive and compared the company with Nvidia. He believes MU has “substantial” upside potential.

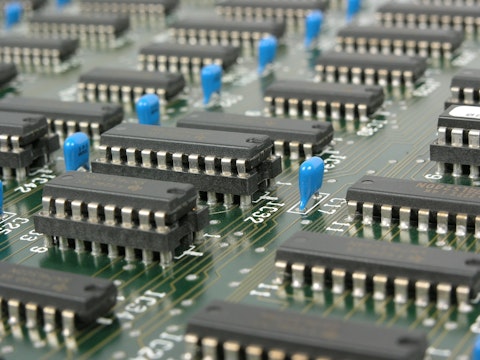

“There’s still, in my opinion, a lot more upside here. You know, we’re looking at 50% quarter-over growth in terms of the high bandwidth memory chips that they are now supplying to Nvidia. The fact that Micron Technology Inc (NASDAQ:MU) trades at only 11 times forward earnings is really what leads me to believe that there’s substantially more upside left in Micron. You see the fact that in the last couple of quarters, they’ve raised guidance substantially both on revenues and earnings, but more importantly for me, they’ve expanded their margins in just the last couple of quarters from 18% to 22% in terms of net margins. That’s not quite the same numbers we’re seeing out of Nvidia, but it’s growing nearly as fast as Nvidia from both the revenue and EPS perspective. They are clearly focusing their attention on a much higher margin business than they have historically been. And that’s why the fact that it only trades at 11 times forward earnings, I think is one of the most undervalued hardware plays within the AI space. And you look at the fact that Samsung, which is the largest player in this particular space of high bandwidth memory chips that go into the GPUs for these AI infrastructure or AI data centers, it’s very clear that Micron is stealing a substantial amount of market share away from Samsung in just the last quarter alone. And that’s really kind of why we’re seeing such high growth in this particular space. So the fact that it only trades at 11 times forward earnings I think is one of the cheapest plays. You know you compare that to Nvidia and I don’t think it’s a fair comparison to put Micron Technology Inc (NASDAQ:MU) in the same league as Nvidia but the fact that they’re a major supplier for Nvidia chips and Nvidia trades at over 40 times forward earnings, growth rates very similar, and the only difference between Nvidia and Micron Technology Inc (NASDAQ:MU) is the fact that net margins are 22% for Micron versus over 50% for Nvidia.”

Baird Chautauqua International and Global Growth Fund stated the following regarding Micron Technology, Inc. (NASDAQ:MU) in its second quarter 2025 investor letter:

Micron Technology, Inc. (NASDAQ:MU): U.S. semiconductor companies performed well in 2Q25, with the Philadelphia Semiconductor Sector Index (SOX) up 29% in the quarter. Micron gained 42% thanks to strong sales growth in high-bandwidth memory (HBM) DRAM, which is essential for AI computing.

While we acknowledge the risk and potential of MU as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than MU and that has 10,000% upside potential, check out our report about this cheapest AI stock.

READ NEXT: 30 Stocks That Should Double in 3 Years and 11 Hidden AI Stocks to Buy Right Now.

Disclosure: None. This article is originally published at Insider Monkey.