As a Foolish writer, I try to keep my non-financial beliefs expressed here to a minimum. Most of the time, most of the readers coming to this site do so because they’re looking for help navigating what can be a confusing, chaotic investment landscape. Usually, readers aren’t looking for non-financial advice.

Our own Alyce Lomax has led the charge here at the Fool, with her Prosocial investing portfolio, to help offer one way of approaching these dilemmas.

I’m not here today to tell you what should or shouldn’t be your moral investing compass — that’s a very personal decision that every investor needs to make for him or herself. Instead, I want to talk about a dilemma I’m having right now, why I’ve been having it, and, more than anything, to at least get a little discussion going here about some of the tough questions we investors face on a daily basis.

Considering a big change to my retirement portfolio

About two years ago, I started a real-life portfolio I dubbed “The World’s Greatest Retirement Portfolio.” The premise was pretty simple: I would be investing $4,000 in each of 10 companies I was calling out and attempting to hold those investments for a bare minimum of three years. The results so far have been encouraging, as the portfolio has returned over 26%, and is beating the broader market by about four percentage points.

I have, however, already broken my promise to hold all 10 stocks for at least three years. Back in Sept. 2012, I decided to part ways with video game company Activision Blizzard, Inc. (NASDAQ:ATVI).

While visiting my middle-school-aged cousins last year, I observed them playing Activision’s latest iteration of “Call of Duty.” Afterward, I couldn’t get over the glazed-over look they had in their eyes –and the violence and social detachment the game fostered — out of my mind. For me (and not necessarily for you, dear Fool), I just couldn’t hold shares of the company anymore.

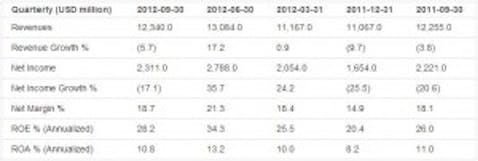

In its place, I decided to buy shares of Chinese search engine Baidu.com, Inc. (ADR) (NASDAQ:BIDU). Although I recognized the concerns about the Chinese government holding a tight clamp on the company, I generally think that opening up information to larger portions of the world’s most populous country is a good thing.

Next up for consideration

More recently, I’ve been reconsidering another one of my investments: The Coca-Cola Company (NYSE:KO). Back when I decided to select the company, I focused on its financial fortitude against competitors, the strength of its dividend, and its undeniable brand reputation.

Don’t get me wrong; when I was a middle school teacher, Diet Coke was the fuel that kept most of our staff — myself included — running. It was our liquid-gold. I probably averaged three Diet Cokes per day!

But since I stopped teaching and read up on some of the side effects of drinking so much soda, I haven’t touched the stuff. And with my first child on the way, my wife and I know that we’ll be doing everything we can to stick to the beverages that naturally occur, namely water and real fruit juices.

To be fair, there’s more to The Coca-Cola Company (NYSE:KO) than just its namesake Coke and Diet Coke. The company also owns several juice companies — Simply, Minute Maid, Fruitopia, Hi-C, Fuze and Odwalla, to name a few — that offer up healthier fare.

But I’m not certain that balances out what the company’s core product does to most Americans. Consider that the average American drinks 126 regular Cokes per year. That means that they ingest 10.8 pounds of processed sugar each year in the form of Coke alone.

According to guidelines from the American Heart Association, that means that Coke alone accounts for about 40% of the ideal yearly sugar allowance for men and 55% for women.

Source: OnlineNursingPrograms.com.

Add into that equation the fact that elevated levels of sugar consumption have been found to have significant correlations to both heart disease and type 2 diabetes, and you can see why I’m starting to consider replacing this company in my portfolio. Indeed, the very first risk factor the company lists in its annual report is “Obesity and other health concerns may reduce demand for some of our products.”

For me, if a company carries a product that I’m simply unwilling to allow my future child to have, then maybe that’s a good litmus test for whether I should try to profit from the product’s proliferation. When the time comes this summer for me to reasses this portfolio, don’t be surprised to see Coke coming off the list.

If I’d like to stay within the beverage industry, I’d be far more likely to consider SodaStream International Ltd (NASDAQ:SODA), a company that manufactures at-home carbonators with syrup additives. My wife and I have our own, and though we’ve stayed away from the syrups, we’re big fans of adding carbonated water to our juices.

Add to that the fact that the company claims to help significantly reduce landfill waste by eliminating millions of plastic bottles, and I could be looking at a future investment.

The article An Investor’s Moral Dilemma originally appeared on Fool.com.

Fool contributor Brian Stoffel owns shares of Coca-Cola and Baidu. The Motley Fool recommends Activision Blizzard, Baidu, Coca-Cola, and SodaStream. It owns shares of Activision Blizzard, Baidu, and SodaStream.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.