Doomsday preppers may keep cash and gold around, but how much cash will you carry around in say…two to five years? The cashless society has proven so dire for Kenyan pickpockets they held a press conference begging legislators to do something to protect their profession.

Not an Onion news report, these were real pickpockets. The solution according to pickpockets is for the government to train them to skim ATM cards. Really?! The threat to their livelihood is all too real, however; as of April, New Zealand is almost a cashless society according to Mastercard Inc (NYSE:MA). There are three main beneficiaries of the cashless trend, American Express Company (NYSE:AXP), the aforementioned Mastercard Inc (NYSE:MA), and Visa Inc (NYSE:V).

Although financials, these three have few of the risks of banks. As toll collectors for transactions there is little downside risk with tiny fees on billions of transactions annually. Visa Inc (NYSE:V)’s VisaNet processor is capable of processing 30,000 transactions per second.

With 60% penetration in the US electronic payments space the credit card companies seek growth overseas. China is a no-go as the government has shut out foreign cards in favor of its China UnionPay. India is a huge market with only 8% of all transactions taking place electronically.

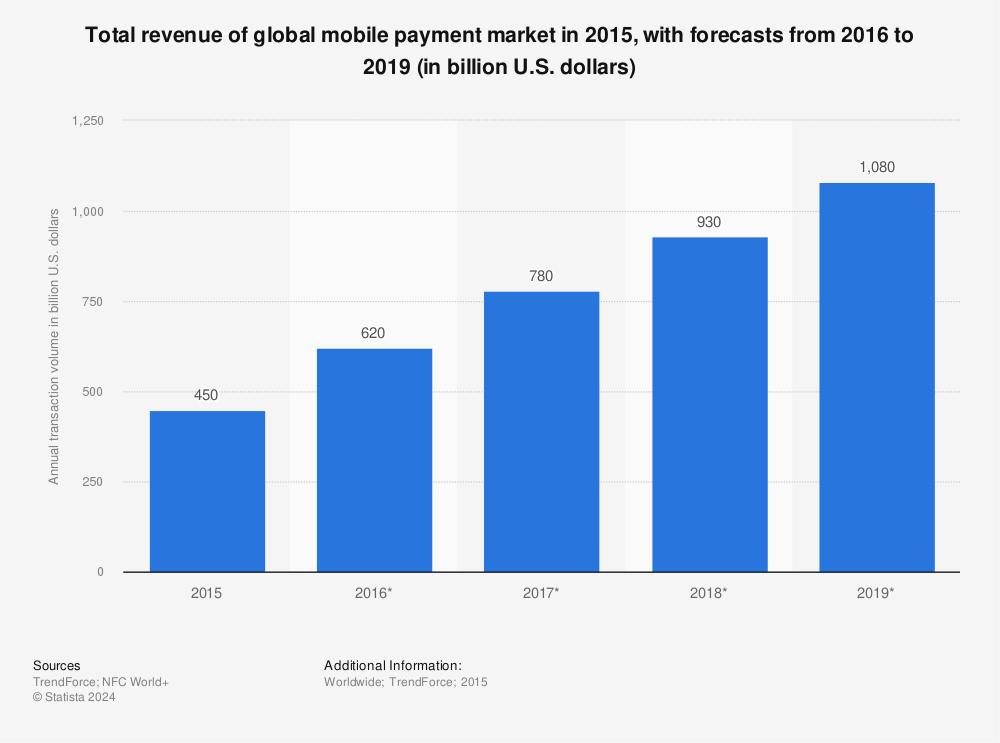

You will find more statistics at Statista

Everywhere you want to be?

Visa Inc (NYSE:V) will be reporting on July 24, and if past is prologue investors should be cheered by results. As the biggest dog in the global payment network space Visa is best poised to benefit from a cashless society. Currently 85% of financial transactions are still by cash or check worldwide so that leaves a huge addressable market for all three credit card names.

By 2015 Visa Inc (NYSE:V) expects fully half of global revenues to be ex-United States. It is expanding its mobile wallet solutions to capture the ever-growing e-commerce and mobile payment market. Here, like its rivals, it will be challenged by eBay Inc (NASDAQ:EBAY)’s PayPal, privately held Square, and Google. Visa acquired CyberSource in 2011 to help build its mobile wallet business.

Also challenging these three are increasing credit card delinquencies, litigation, the effect of Dodd-Frank, and any other regulations legislators dream up, like the Durbin amendment to Dodd-Frank which limited processing fees to $0.22 per transaction.

Trefis gives a price target for Visa of $150, a full 15% below its recent price of $188.00. There is historical basis for such a hit to share price as during the time when regulation uncertainty was hanging like a sword of Damocles over these payments processors the share price declined just around 15% for Visa Inc (NYSE:V) and even more for its brethren.

Don’t leave home without it?

American Express Company (NYSE:AXP) differs from these as it does have lending risk associated with its cards, unlike Visa and Mastercard Inc (NYSE:MA) which expect the associated banks to assume that risk.

Now, American Express Company (NYSE:AXP) is a Warren Buffett hold at 12% of his portfolio and 13.74% of outstanding American Express shares. He understands that American Express is a company that attracts higher-net worth individuals to its financial products and travel-related services.

American Express Company (NYSE:AXP) is still a toll road, but it decides who gets on the road in the first place, preferring the prosperous who can afford the annual fee and can pay off a full balance every month. As the company presented at the William Blair Growth Stock Conference in June the American Express Company (NYSE:AXP) cardholder outspends the Visa and Mastercard Inc (NYSE:MA) holder nearly three to one and five to one with the proprietary (i.e. premium) Gold, Platinum, Black, etc. cardholders.