American Eagle Outfitters (NYSE:AEO) is one of the leading specialty retailers targeting the younger consumers (and the young at heart). With rising revenues, a pretty solid track record of earnings, and one of the better dividend yields in the sector, American Eagle Outfitters (NYSE:AEO) seems to be doing just fine. Additionally, despite their success, shares are still about 18% below their 52-week high, at a time when the entire market seems to be making new highs daily. Could American Eagle Outfitters (NYSE:AEO) possibly be one of the few bargains left in this bull market?

American Eagle Outfitters (NYSE:AEO) sells casual apparel, footwear, and accessories, primarily aimed at the young adult (15 to 25) demographic, a group that accounts for about 23% of all apparel spending. The company also has a thriving children’s apparel business, making up about 17% of the company’s total sales. The rest is dominated by women’s apparel (55%), with men’s making up the rest.

The company currently has about 900 locations, and is currently growing its other brands, such as “aerie,” which targets young females, and also through the renovation of existing stores. The company plans approximately 50 renovations this year.

The Numbers

Some quick stats on American Eagle Outfitters (NYSE:AEO), which we’ll use to compare the company with its competitors a little later. American Eagle Outfitters (NYSE:AEO) trades for just 14.1 times fiscal year 2013’s earnings (which ended January 31), and the consensus calls for pretty nice growth going forward. American Eagle is projected to earn $1.49 per share for the current fiscal year (2014), and this amount is projected to rise to $1.68 and $1.88 in fiscal years 2015 and 2016, respectively. This translates to a 3-year average forward growth rate of 10.6% annually, much better than is generally associated with such a low P/E.

Now, a lot of the time, a reason for a low P/E relative to growth is a poor balance sheet. So, American Eagle must have considerable debt, right? Wrong. In fact, the company has absolutely zero long-term debt and about $630 million in cash. This is extremely significant for a company whose total market cap is about $3.8 billion. When accounting for the cash in the valuation, American Eagle’s business alone is trading for just 11.8 times earnings.

All looks pretty good so far. Let’s see how the company stacks up to its competitors in this very competitive sector.

The Competition: Lots of It!

There is certainly no shortage of competition in this sector. A quick stock screen reveals 41 similarly sized apparel companies on the major exchanges. For the purposes of this comparison, let’s take a look at two companies with similar target customers and similar product pricing: Abercrombie & Fitch Co. (NYSE:ANF) and Aeropostale, Inc. (NYSE:ARO).

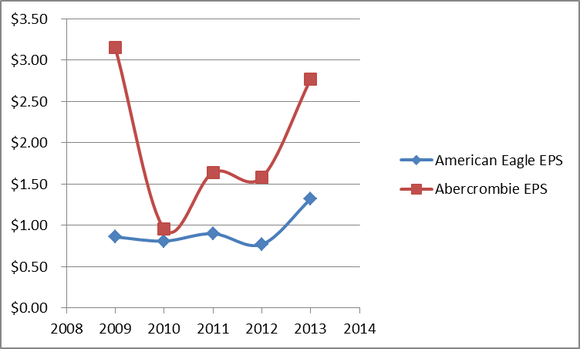

Abercrombie & Fitch Co. (NYSE:ANF) is of similar size and geographical breadth, and operates about 1000 stores of four brands, mostly Abercrombie & Fitch Co. (NYSE:ANF) and Hollister. The company targets the same age group as American Eagle, and also has a thriving kids business. Abercrombie & Fitch Co. (NYSE:ANF) trades at a slightly higher valuation of 18.4 times earnings, however with a higher 13% forward growth rate, so you could say the P/E relative to the projected growth is similar. However, what scares me away is Abercrombie & Fitch Co. (NYSE:ANF)’s somewhat unstable record of earnings (see chart)

Aeropostale, Inc. (NYSE:ARO) trades at the highest P/E of the three at 22.1 times TTM earnings with about 15% forward earnings growth projected. Aeropostale, Inc. (NYSE:ARO), or “aero” as it is known amongst its customers, caters primarily to the narrower 14-17 demographic and operates over 1,000 stores in the U.S. and Canada. Unlike the other two, the company pays no dividend, which is likely to scare off income seekers. I like Aero and think they will enjoy success for many years to come; they are just a bit too expensive right now.

Buy, Sell, Hold?

While a comparison with two of its competitors is by no means exhaustive, American Eagle does indeed seem to be a good value. As the economy continues to improve, discretionary spending will rise, and particularly the money that is given to young adults for the latest clothes. This past year, American Eagle produced its highest revenues ever, and the company should continue to surpass their past performance for several years to come. I feel completely confident calling American Eagle a great value in this ever-rising market.

The article A Bargain Remains in the Apparel Business originally appeared on Fool.com and is written by Matthew Frankel.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.