The bookselling industry was revolutionized by Amazon.com, Inc. (NASDAQ:AMZN), leaving many independent book stores and even national chains struggling to survive. Borders went under in 2011, leaving Barnes & Noble, Inc. (NYSE:BKS) as the only nationwide chain left and Books-A-Million, Inc. (NASDAQ:BAMM) as a distant second.

I recently wrote an article that claimed that Barnes & Noble, Inc. (NYSE:BKS) was actually fairly profitable if you back out its failing hardware business, while Books-A-Million, Inc. (NASDAQ:BAMM) likely doesn’t have a chance in the long term. But what are the odds of either company going bankrupt any time soon? Is it inevitable, or are these traditional book sellers in better shape than people think?

A useful tool

A relatively simple way to judge a company’s bankruptcy risk is by calculating the Altman Z-Score. The Z-score is a sum of five ratios that are calculated from a company’s financial statements, and has been shown empirically to be a fairly good predictor of bankruptcy. The Z-score formula is:

where A-E are defined as:

If the Z-score is greater than 2.99 then the company is considered safe from bankruptcy. Below 1.81 means that the company has a high risk of going bankrupt within the next two years. And in between is the “grey zone,” where the company isn’t in immediate danger of bankruptcy but isn’t in great financial shape either.

Better than expected

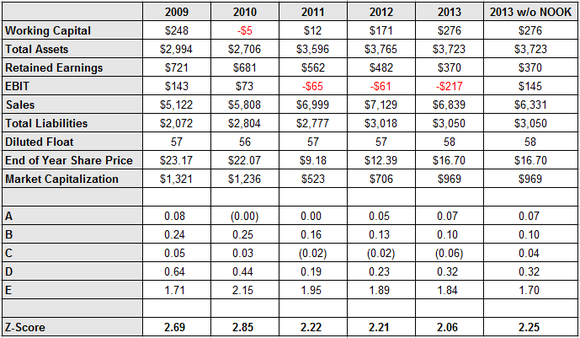

Barnes & Noble, Inc. (NYSE:BKS) recorded a net loss of $155 million in fiscal 2013, which ended in April. This loss was solely the result of its failing Nook tablet business, and backing this out the company would have been profitable. Because of this I’ll calculate the Z-score for both the company as-reported and also for the company sans-Nook. I’ll also look at how the Z-score has changed over the past 5 years to see if any trend is evident. Here are the results for Barnes & Noble:

The Z-score has been trending downward since 2010, but even including the effect of the Nook business Barnes & Noble, Inc. (NYSE:BKS) is still well within the grey zone. Backing out the Nook business by adjusted the EBIT and sales figures increase the Z-score by about 10% to 2.25–still within the grey zone.

What this means is that according to the Z-score Barnes & Noble, Inc. (NYSE:BKS) is not in any immediate danger of going bankrupt, even including the failing Nook business. However, the Z-score is now worse than it was in 2009, and if this decline continues then the company could soon be in real danger.

Much like the PC, tablets are quickly becoming a commodity. Most of the profits are concentrated in the high-end, leaving the scraps for low-end producers like Barnes & Noble and Amazon.com, Inc. (NASDAQ:AMZN). Barnes & Noble never really had a chance when going up against the likes of Amazon.com, Inc. (NASDAQ:AMZN), a company which puts growth ahead of profits at every turn. I expect the tablet business to be phased out, either sold or abandoned altogether, and for the company to go back to its roots. There is a profitable company underneath.

A much smaller competitor

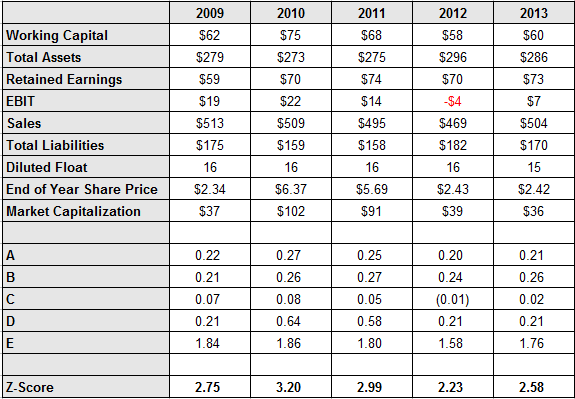

Books-A-Million, Inc. (NASDAQ:BAMM) is far smaller than Barnes & Noble, with just a few hundred stores compared to about 1,300 (including college book stores) for Barnes & Noble. After Border’s closed its doors Books=A-Million became the second largest brick-and-mortar book store in the U.S. Here’s what its Z-score looks like:

Books-A-Million, Inc. (NASDAQ:BAMM) is actually in better shape financially than Barnes & Noble, according to the Z-score at least. Profits have declined, going negative in fiscal 2012, but it looks like Books-A-Million is safe from bankruptcy in the short term. The Z-score has fallen from the safe-zone in fiscal 2010 to the grey-zone now, but fiscal 2013 saw a significant improvement.

Neither of these book sellers are in near-term danger of bankruptcy, although if the trends continue they may be in a couple of years.

Completing the picture

For the sake of completeness let’s look at the Z-score for Amazon.com, Inc. (NASDAQ:AMZN):

As expected the Z-score is well within the safe-zone, but one interesting point does emerge. The bulk of Amazon.com, Inc. (NASDAQ:AMZN)’s Z-score is derived from D, the term which includes the market capitalization. The fact that Amazon has an enormous market capitalization relative to its profits is the only reason why the Z-score isn’t much lower.

Because of this the financial picture isn’t really that great. If Amazon were a $40 billion company today, which is still 28.5 times the highest EBIT from the past 5 years, the Z-score would be 3.02, just barely in the safe-zone.

Now I’m not suggesting that Amazon is in danger of bankruptcy, but in this case the vanilla Z-score doesn’t tell the whole story.

The bottom line

Even though both Barnes & Noble and Books-A-Million, Inc. (NASDAQ:BAMM) have struggled as of late, neither company is in any immediate danger of bankruptcy. Barnes & Noble should be able to reduce its losses this year as it scales back and hopefully eliminates its tablet business, greatly improving the financial condition of the company. Although Amazon has killed many booksellers so far, both of these companies will likely be fine for at least a few years. In the long-term I think that Barnes & Noble is the better bet given its size, as there’s likely room for one national brick-and-mortar book chain. But any near-term bankruptcy fears are overdone.

Timothy Green has no position in any stocks mentioned. The Motley Fool recommends Amazon.com. The Motley Fool owns shares of Amazon.com.

The article Are These Book Sellers In Trouble? originally appeared on Fool.com and is written by Timothy Green.

Timothy is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.