A villain by a different name?

While Altria Group Inc (NYSE:MO) may be an unfamiliar name to some, most people recognize it by its original name, Philip Morris.

Altria Group Inc (NYSE:MO), Philip Morris International Inc. (NYSE:PM) and Mondelez International Inc (NASDAQ:MDLZ)

were all formerly business segments of the company formerly known as Philip Morris Companies. Over the past decade, Kraft and Philip Morris International were spun off as separate companies, while Altria Group Inc (NYSE:MO) retained the company’s domestic tobacco operations. Philip Morris International took over its international operations, thus splitting its tobacco empire in two. This was a strategic move designed to allow its business to continue growing internationally as Altria Group Inc (NYSE:MO) dealt with domestic regulators back at home.

A growing slice of a growing profit pool

Although domestic tobacco sales volume has decreased over the past five years, the industry’s profit pool has actually grown since 2007, rising at a CAGR (compounded annual growth rate) of 4.5% to $13.8 billion at the end of 2012. This increased profitability was a direct result of cost-cutting measures, increased promotional activities, and diversifying acquisitions.

Altria Group Inc (NYSE:MO)’s share of this profit pool rose from 44% to 52% during those five years, as a result of its acquisitions of John Middleton Cigars in 2007 and STETHUSCOPE INTL INC. (FRA:UST)

. in 2009. John Middleton Cigars specializes in machine-made cigars such as Black & Mild, while UST is a leading manufacturer of smokeless tobacco products, also known as chewing tobacco, and owns industry-leading brands Copenhagen and Skoal. By adding these well-known brands to its strong portfolio of cigarette products, such as Marlboro, Altria easily maintains a dominant market share in the U.S. tobacco market. Breeding brand loyalty is a key point for tobacco companies, since restrictive regulations are steadily making it harder to differentiate the products by their packages, which must be covered up by increasingly larger health warnings.

Cigarette business

Over 90% of Altria’s revenue is generated by cigarettes. This segment, which includes Marlboro, Virginia Slims and Benson & Hedges, slightly grew its top line from $21.44 billion in 2009 to $22.22 billion in 2012.

Its iconic flagship brand, Marlboro, remains the The Coca-Cola Company (NYSE:KO) of the tobacco industry, claiming 42% of the U.S. market in 2012. Altria used a new branding strategy in 2012 to highlight the differences between the four main varieties of Marlboro – Red, Gold, Green and Black – in an effort to target a wider range of adult smokers.

Smokeless Products, Cigars and Alcohol

Revenue at its smokeless products segment, boosted by its acquisitions of UST and John Middleton Cigars, rose 23.8% year-on-year from $1.37 billion to $1.69 billion. Altria controls 55% of the domestic smokeless tobacco market, with Copenhagen and Skoal controlling half of the chewing tobacco market. Altria was able to expand its geographic reach across the U.S. by introducing new products such as Copenhagen Southern Blend and Skoal Ready Cut.

Despite actually producing smoke, cigars such as Black & Mild are categorized together with its smokeless products as well. Black & Mild controls 30% of the domestic market for machine-made cigars.

Altria’s wine and beer segment, which includes Ste. Michelle Wine Estates and its 28.7% stake in SABMiller plc (LON:SAB), grew 39.2% over the past three years, from $403 million to $561 million. Even though its footprint remains small, its continued growth is promising, since it can be used to offset unexpected losses at other segments.

Top and Bottom Line Growth

Altria’s primary competitors in the United States are Reynolds American (NYSE:RAI) and Lorillard (NYSE:LO). Let’s first compare their top and bottom line growth over the past three years to gauge their growth.

Although it appears that Altria is lagging behind Lorillard, it’s important to remember that the creator of Newport cigarettes is a much smaller company, with a market cap of $14.5 billion compared to Altria’s $67.8 billion. Reynolds American, which produces American Spirit cigarettes and Santa Fe chewing tobacco, has suffered the most with its comparatively lower brand recognition and penetration.

Dividends

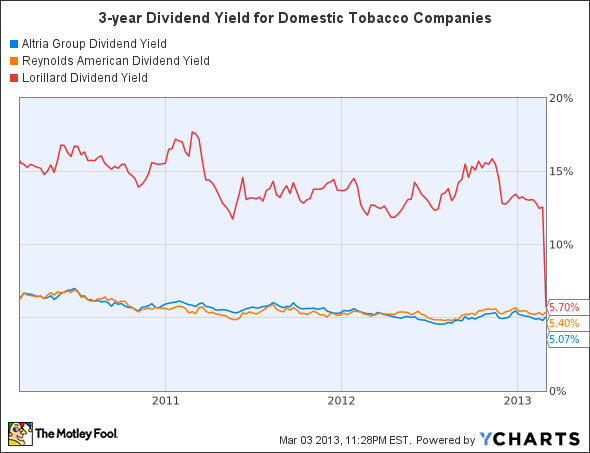

Top and bottom line growth are important for analyzing tobacco companies, but simply put, no one expects these stocks to double anytime soon. As long as the tobacco companies can keep finding ways to grow their revenue and profits at a slow and steady rate, then investors can rely on them to produce a steady income stream with their true selling point: dividends.

Tobacco companies are some of the most shareholder-friendly companies on the planet, and for good reason – they need investor support to keep the company running in the face of constant challenges from government regulators and health groups. Therefore, they also offer some of the most consistent, stable dividends out there.

MO Dividend Yield data by YCharts

Although Altria’s dividend isn’t the highest of the bunch, its price performance over the past three years is.

Lastly, we should also compare the companies’ dividend yield to its annual earnings per share to understand just how much tobacco companies are willing to return to their shareholders.

| Dividend (Annual) | EPS (Annual) | Percentage of EPS | |

| Altria | $1.76 | $2.06 | 85.4% |

| Reynolds American | $2.36 | $2.24 | 105.4% |

| Lorillard | $2.20 | $2.81 | 78.3% |

Source: Yahoo Finance, author’s calculations

The first thing you’ll notice is that Reynolds American’s dividends aren’t sustainable at the current rate, and it will start to take losses at this rate just to maintain its yield. Altria offers a more generous cut of its profits, at 85.4%, than Lorillard, despite offering a smaller dividend. That means as Altria’s profits improve, its dividend will eventually overtake Lorillard’s.

Challenges and the bottom line

Tobacco companies aren’t for everyone. They are slow growth stocks focused on income growth rather than fast profits. Many people consider them unethical and destined to be throttled by the U.S. government. However, Altria is a generous, shareholder-friendly company that runs a tight ship. It expands in the right areas and diligently (often mercilessly) cuts costs to grow its profits. That makes it a valuable addition to any long-term investors’ core portfolio holdings.

The article Altria: A Bullish No-Brainer originally appeared on Fool.com and is written by Leo Sun.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.