The 800+ hedge funds and famous money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the second quarter, which unveil their equity positions as of June 30th. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund portfolios. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards AGNC Investment Corp. (NASDAQ:AGNC).

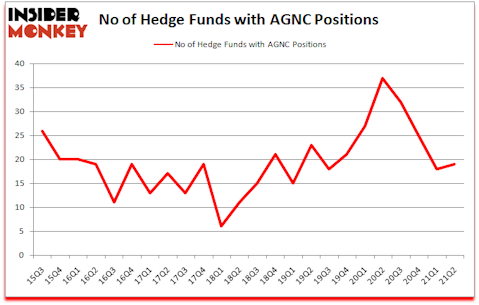

AGNC Investment Corp. (NASDAQ:AGNC) was in 19 hedge funds’ portfolios at the end of the second quarter of 2021. The all time high for this statistic is 37. AGNC has seen an increase in hedge fund interest of late. There were 18 hedge funds in our database with AGNC holdings at the end of March. Our calculations also showed that AGNC isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

If you’d ask most stock holders, hedge funds are viewed as unimportant, old financial vehicles of the past. While there are greater than 8000 funds trading today, Our researchers hone in on the top tier of this group, around 850 funds. These money managers control the majority of the smart money’s total asset base, and by tailing their unrivaled picks, Insider Monkey has discovered numerous investment strategies that have historically exceeded Mr. Market. Insider Monkey’s flagship short hedge fund strategy outperformed the S&P 500 short ETFs by around 20 percentage points per annum since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 185.4% since March 2017 (through August 2021) and beat the S&P 500 Index by more than 79 percentage points. You can download a sample issue of this newsletter on our website.

Joshua Friedman of Canyon Capital Advisors

Keeping this in mind let’s take a glance at the latest hedge fund action encompassing AGNC Investment Corp. (NASDAQ:AGNC).

Do Hedge Funds Think AGNC Is A Good Stock To Buy Now?

At the end of June, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 6% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in AGNC over the last 24 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Canyon Capital Advisors, managed by Joshua Friedman and Mitchell Julis, holds the biggest position in AGNC Investment Corp. (NASDAQ:AGNC). Canyon Capital Advisors has a $58 million position in the stock, comprising 2.2% of its 13F portfolio. The second most bullish fund manager is Renaissance Technologies, which holds a $45.2 million position; 0.1% of its 13F portfolio is allocated to the stock. Some other members of the smart money with similar optimism encompass Karim Abbadi and Edward McBride’s Centiva Capital, and Karim Abbadi and Edward McBride’s Centiva Capital. In terms of the portfolio weights assigned to each position Canyon Capital Advisors allocated the biggest weight to AGNC Investment Corp. (NASDAQ:AGNC), around 2.16% of its 13F portfolio. Neo Ivy Capital is also relatively very bullish on the stock, setting aside 0.87 percent of its 13F equity portfolio to AGNC.

As aggregate interest increased, key hedge funds were leading the bulls’ herd. Centiva Capital, managed by Karim Abbadi and Edward McBride, initiated the most valuable call position in AGNC Investment Corp. (NASDAQ:AGNC). Centiva Capital had $29.6 million invested in the company at the end of the quarter. Karim Abbadi and Edward McBride’s Centiva Capital also initiated a $13.2 million position during the quarter. The other funds with brand new AGNC positions are Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Dmitry Balyasny’s Balyasny Asset Management, and Renee Yao’s Neo Ivy Capital.

Let’s go over hedge fund activity in other stocks similar to AGNC Investment Corp. (NASDAQ:AGNC). These stocks are SEI Investments Company (NASDAQ:SEIC), Western Midstream Partners, LP (NYSE:WES), Nielsen Holdings plc (NYSE:NLSN), Builders FirstSource, Inc. (NYSE:BLDR), ICL Group Ltd. (NYSE:ICL), Ciena Corporation (NYSE:CIEN), and Berry Global Group Inc (NYSE:BERY). This group of stocks’ market valuations resemble AGNC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SEIC | 24 | 294844 | -3 |

| WES | 9 | 162783 | 1 |

| NLSN | 28 | 1991569 | -6 |

| BLDR | 60 | 1946230 | 12 |

| ICL | 6 | 73199 | 2 |

| CIEN | 29 | 356029 | 2 |

| BERY | 37 | 1370409 | -5 |

| Average | 27.6 | 885009 | 0.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27.6 hedge funds with bullish positions and the average amount invested in these stocks was $885 million. That figure was $152 million in AGNC’s case. Builders FirstSource, Inc. (NYSE:BLDR) is the most popular stock in this table. On the other hand ICL Group Ltd. (NYSE:ICL) is the least popular one with only 6 bullish hedge fund positions. AGNC Investment Corp. (NASDAQ:AGNC) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for AGNC is 33.4. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through October 22nd and surpassed the market again by 1.6 percentage points. Unfortunately AGNC wasn’t nearly as popular as these 5 stocks (hedge fund sentiment was quite bearish); AGNC investors were disappointed as the stock returned 0.2% since the end of June (through 10/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2021.

Follow Agnc Investment Corp. (NASDAQ:AGNC)

Follow Agnc Investment Corp. (NASDAQ:AGNC)

Receive real-time insider trading and news alerts

Suggested Articles:

- 20 Best Social Media Apps in 2021

- 10 Best Stocks for Beginners with Little Money

- 25 Best Caribbean Islands To Visit

Disclosure: None. This article was originally published at Insider Monkey.